2023 was yet another “prove it” year for the golf industry. Following a notable surge in golf participation during the pandemic, many in the industry expected a decline in 2022. But as we outlined in last year’s Golf Industry Trends Report, North American courses that use Lightspeed experienced growth in both rounds and sales last year.

On the heels of a 2022 that exceeded expectations, the question for 2023 remained the same: could this momentum continue? Or would the industry see regression? Encouragingly, an early look at the data indicates that 2023 was yet another year of growth.

Not only does the National Golf Foundation (NGF) report that year-to-date (YTD) October 2023 US rounds are trending 3% ahead of YTD October 2022 totals (and well ahead of pre-pandemic averages), but aggregated customer data from Lightspeed golf courses across North America shows year-over-year (YOY) gains in sales volume.

Keep reading to learn about where and when Lightspeed courses saw growth as well as which golf industry trends owners and operators should keep an eye on as we head into a pivotal 2024.

- Comparing total sales volume in 2023 vs 2022

- Comparing pro shop sales and food and beverage sales

- How did transaction size change year over year?

- Inflationary effects

- March and November: Big months for big ticket sales

- Black Friday Success: Sioux Falls Golf

- Key takeaways

- Key golf industry trends for 2024

- The growing participation in off-course golf

- Cost of the on-course game and its impact on play

- AI and automation at the golf course

- Grassroots participation, diversity, access and inclusion

The 2023 State of the Golf Industry Report

Want to learn more about the state of the industry? Download our free 2023 report now!

Coming off a strong 2022, Lightspeed courses saw continued growth in transaction volume in 2023

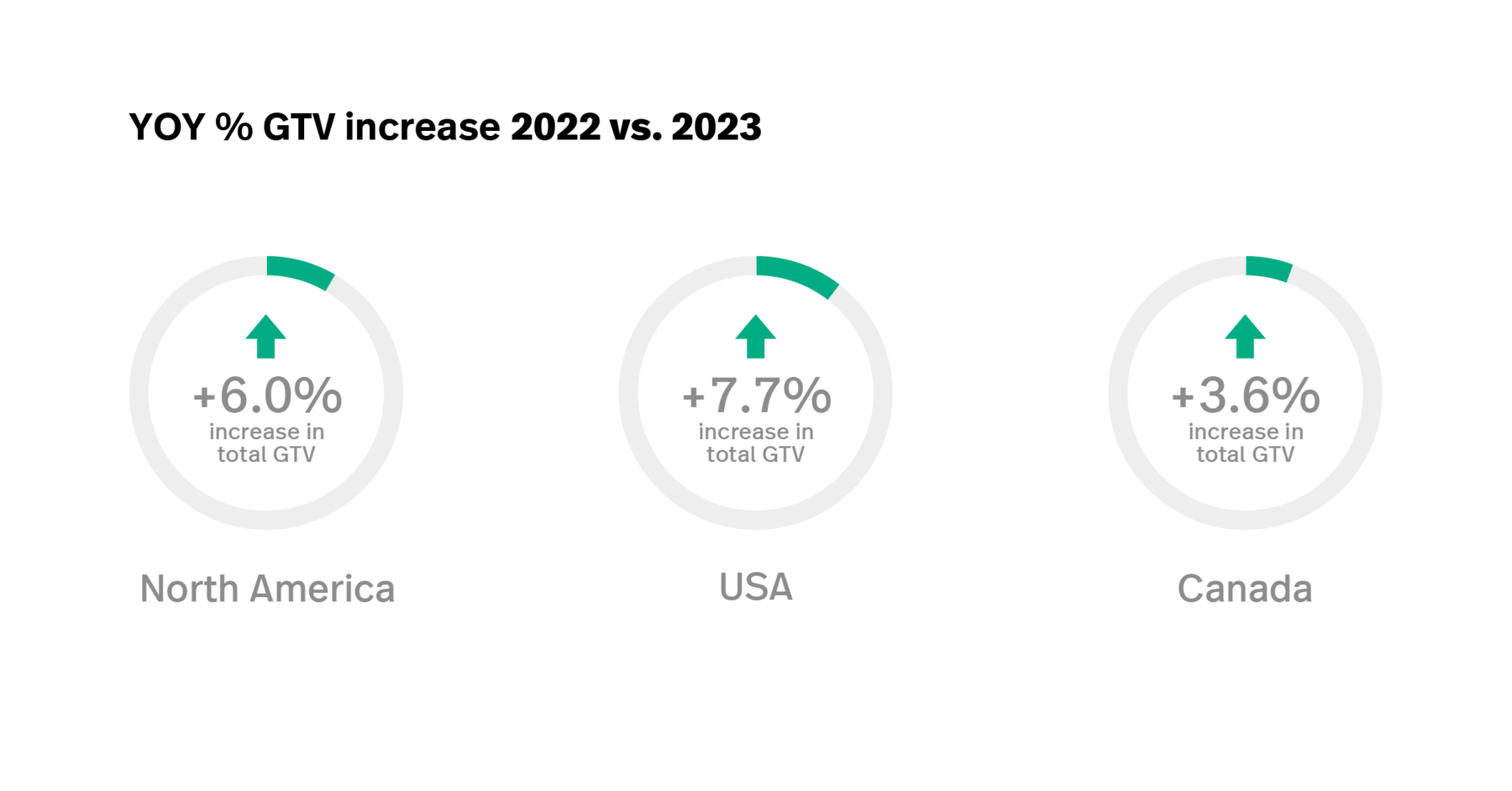

Averaging out transaction data from the golf courses that use Lightspeed’s golf management software across North America, Gross Transaction Volume (GTV)1, 2 increased between YTD November 2022 and YTD November 2023.

2023 golf retail transaction volume vs. food and beverage transaction volume

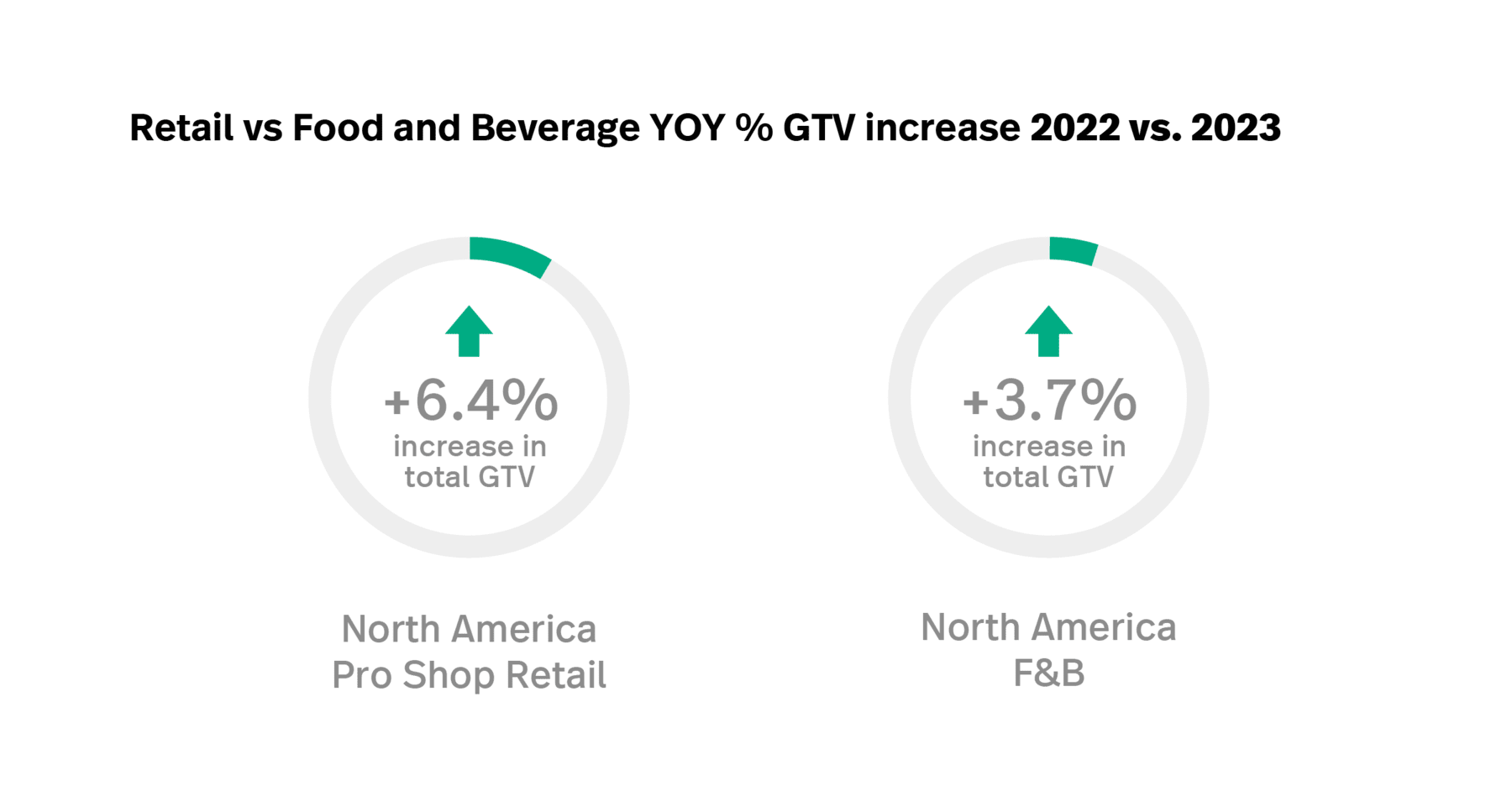

In our breakdown of 2022 North American Lightspeed course data, one figure that really stood out was the YOY increase in same-store food and beverage (F&B) sales when compared to 2021. F&B sales had the biggest effect on the growth in total GTV through 2022, nearly tripling the YOY growth seen in same-store retail/pro shop GTV.

Fast-forward to 2023, and it’s clear to see a more balanced distribution of growth across retail/pro shop transactions and those made at the beverage cart, in the restaurant or at the halfway house.

A look at YOY % changes in average transaction size

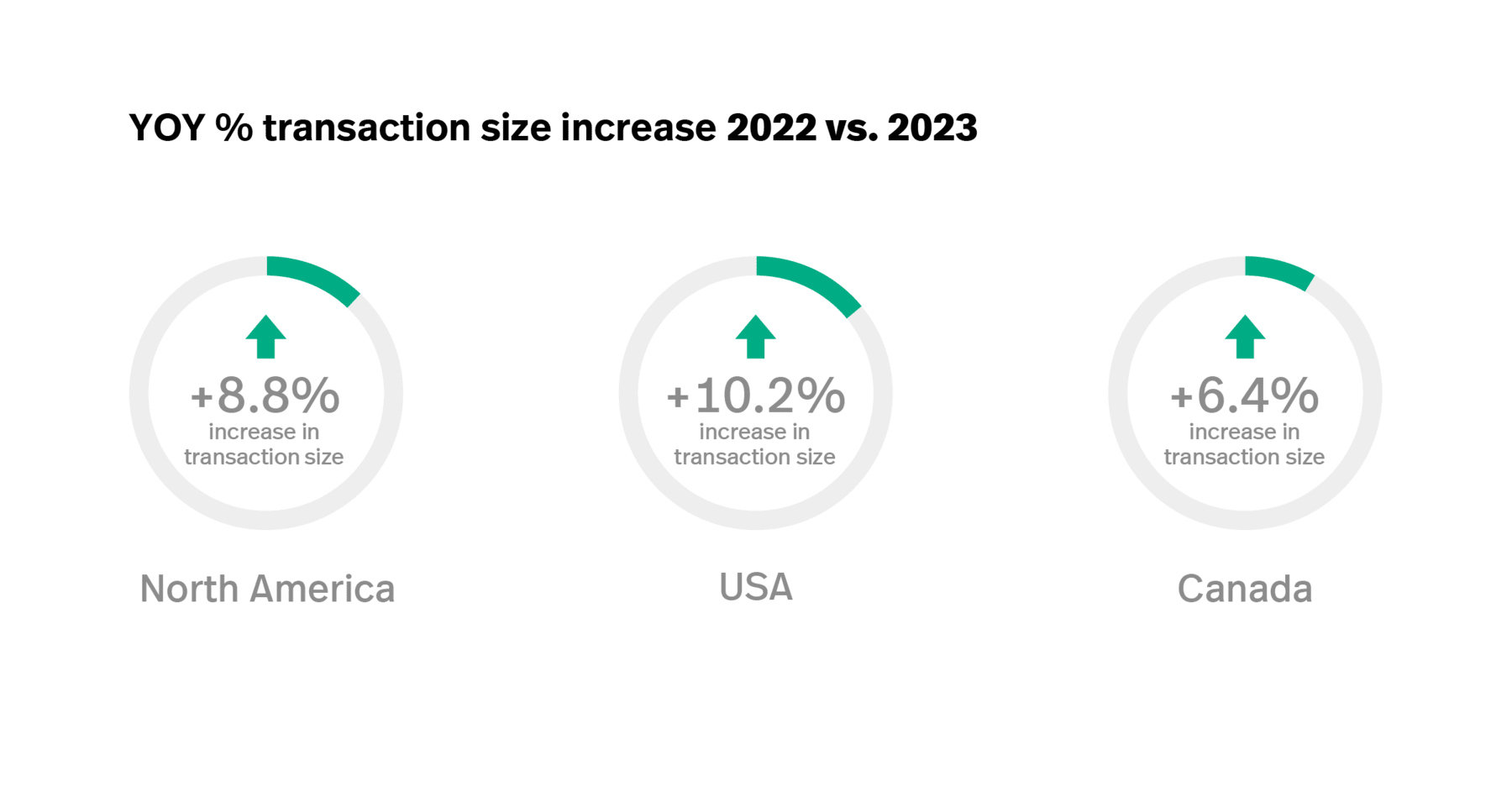

Comparing the total increases in transaction size across North American Lightspeed courses yields some interesting findings.

Inflationary effects

Inflation was a term you couldn’t escape in 2023, and the golf industry was not immune to its effects. That said, Lightspeed courses in the United States and Canada saw an increase in average transaction size through much of 2023 that was able to outpace the average consumer price index (CPI) increase.

Big months for big-ticket sales

The YOY growth in transaction size in both Canada and the United States was punctuated by two particularly strong months: March and November.

Golf retail transactions drove these particularly sharp increases during March and November. And when you consider the fact that these months align with key sales and marketing periods for golf courses, it’s not difficult to see why:

Golf industry trends suggest that March is a time when thousands of courses across the United States and Canada launch start-of-season promotions, membership drives, subscription campaigns, etc. With spring and the start of the season looming, March is also when golfers will head to their pro shop to find deals on bigger ticket items such as golf equipment and apparel.

Furthermore, November is a key retail month across all industries. With Black Friday, Cyber Monday and the start of the holiday shopping season, this is an ideal time for golf courses across North America to run discounts on round packages and more expensive merchandise.

Black Friday Success: Sioux Falls Golf

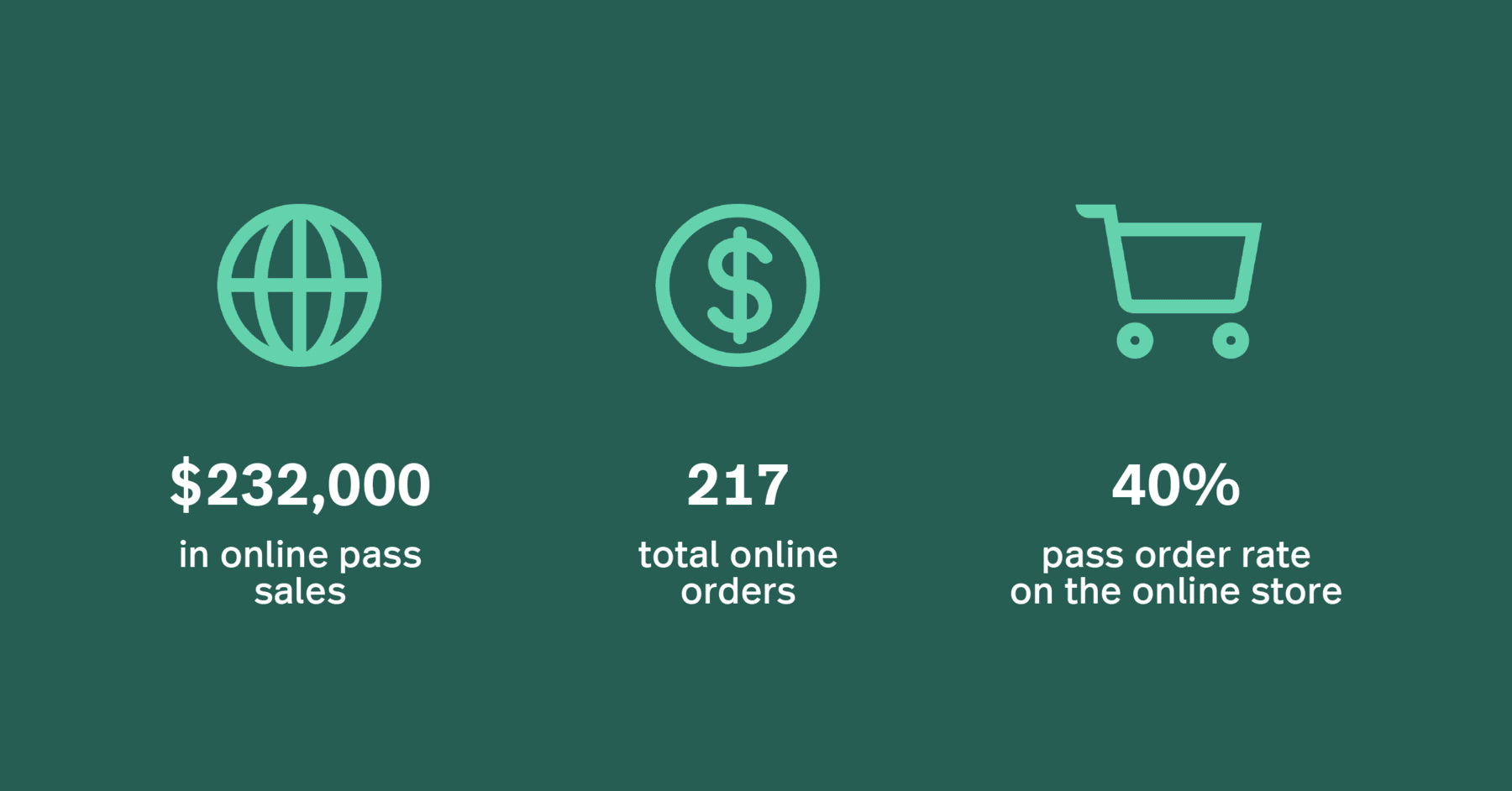

For proof of how leveraging pivotal shopping periods can drive larger transactions, look no further than Sioux Falls Golf. In order to drive play, Sioux Falls Golf sells annual memberships that give golfers access to all three of their municipal golf courses.

Over the 2023 Black Friday period Sioux Falls Golf sold over $250,000 of these annual passes. Using Lightspeed eCom, online sales account for 92% of this total.

Key takeaways

These surges in transaction size during pivotal months of the year reinforce how important it is for golf courses to have access to clean, accurate, actionable data that illustrates (among other things):

- When golfers historically purchase passes, memberships and merchandise

- Which golfers to target with remarketing efforts

- The success of specific campaigns, drives and promotions

- The breakdown of online versus in-store purchases

- Which passes, subscriptions, memberships and SKUs drive the most purchases among different customer types and demographics

With the right insights at your disposal, you can better time (and target) your sales and marketing efforts, push bigger ticket items and drive revenue at pivotal moments throughout the year.

Key golf industry trends to monitor in 2024

With the explosive growth and popularity of off-course golf, pressing questions of access and inclusion, the growing influence of AI and automation on business operations and more, there are plenty of golf industry trends to monitor as the calendar turns to 2024.

1. The growing participation in off-course golf

It would be a mistake to characterize golf’s surge in popularity as a strictly on-course phenomenon. Thanks to venues like Topgolf and the newfound accessibility of golf simulator technology, off-course golf has altered the way millions of people enjoy the game.

- According to the NGF, the amount of Americans participating in simulator golf has grown 73% since 2019.

- Of the approximately 6.2 million Americans using golf simulators, more than half (53%) don’t play traditional on-course golf.

- The Professional Golfers’ Association reports that, of the 16.3 million golfers across the UK and Ireland, 11.4 million are exclusively off-course golfers.

- Nearly half of these golfers are women (47%) and are more diverse in terms of social background and ethnicity than it is for on-course golf.

The popularity of off-course golf formats is a welcome trend, but it’s also an unsurprising one: ball and club tracking technology has advanced to the point where it’s no longer only accessible to elite professionals and club manufacturers. This is technology with an incredible amount of commercial potential and the industry is now starting to see that potential realized.

Why golf courses should embrace off-course golf

While it may be difficult for traditionalists to hear, off-course golf holds great appeal for mass audiences. While millions of people have an interest in trying golf, only a certain subset of them will want to commit to the time, cost and relative difficulty of the on-course game. It’s far easier for those on golf’s periphery to commit to a night of socializing, watching sports and hitting the occasional shot at Topgolf than it is to playing 18 (or even 9) holes.

Rather than see this as any sort of threat, golf course operators should embrace this change. From simulator bays and putting courses to an enhanced driving range experience, the growing interest in off-course golf presents facilities with the opportunity to scale their operations and add new services that all golfers will love.

2. Cost of the on-course game and its impact on play

The cost of golf is a barrier to entry for many who are looking to try the game. Setting aside the high costs of equipment and apparel, the cost of green fees have undeniably risen during golf’s boom years.

The NGF reports that peak season rates are cumulatively up 15% since 2021. And while 2023 is set to be another year of participation growth, the percentage of core golfers playing less than normal is about twice as high as those playing more than normal.

While it’s entirely justifiable for operators to raise prices to keep up with demand and inflation, it’s also important to monitor the continued impact of rising green fees to ensure that encouraging golf industry trends around participation aren’t derailed by economic factors.

3. AI and automation

No industry is immune to the growing impact of AI and automation on customer-facing and back-office operations. For golf course operators, AI tools and the automation of processes can create key efficiencies and improve the customer experience both at the course and online.

Customer-facing tools like AI chatbots and GPS-activated mobile self check-in can help high-occupancy courses speed up service without sacrificing customer satisfaction. On the back end, tools like automated dynamic pricing, Business Intelligence, automated inventory management and AI-powered weather benchmarking tools are quickly becoming industry standards: they help golf courses maximize revenue, simplify operations and make data-backed decisions in real time.

With on-course golf still surging, customer expectations on the rise and more demand for alternative types of experiences, finding ways to leverage AI and automation at the course will be key in 2024 and beyond.

4. Grassroots participation, diversity, access and inclusion

According to the NGF, the three demographic groups that have seen the largest jump in participation since 2019 are: juniors (36%), people of color (17%) and women (15%). These figures are highly encouraging, and yet they do not distract from the fact that golf is still largely, middle aged, white and male.

Encouraging more active participation in golf, whether on-course or off, from diverse audiences is vital to the healthy growth and sustainability of the game. This is only possible through a commitment to grassroots efforts and creating more public, accessible avenues to golf regardless of age, gender, race, ethnicity or economic standing.

Coming off of another very strong year of golf participation, amplifying the voice, reach and impact of groups like The First Tee, Make Golf Your Thing, The National Links Trust, Women’s Golf Day and other community initiatives will be crucial in 2024.

For golf course operators, 2024 should be the year to partner with groups like the ones above, break down barriers to entry, engage in community outreach and set up opportunities for new golfers to meet, socialize and have fun at the course.

Here’s to keeping the momentum going in 2024

In light of these golf industry trends, the future is bright for customer-centric courses who are continuously leveling up their operations and finding ways to simplify, scale and provide exceptional experiences for all golfers.

At Lightspeed, we’re committed to serving ambitious golf courses who want to succeed and thrive—now and in the future. Watch a demo of Lightspeed Golf and discover why thousands of golf courses choose our platform to run and grow their businesses.

Disclaimers:

1. Key Performance Indicators: We monitor “Gross Transaction Volume” or “GTV”as a key performance indicator to help us evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions. Our key performance indicators may be calculated in a manner different from similar key performance indicators used by other companies.

2. Forward-Looking Statements: This report may include forward-looking information and forward-looking statements within the meaning of applicable securities laws (“forward-looking statements”). Forward-looking statements are statements that are predictive in nature, depend upon or refer to future events or conditions and are identified by words such as “will”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” or similar expressions concerning matters that are not historical facts. Such statements are based on current expectations of Lightspeed’s management and inherently involve numerous risks and uncertainties, known and unknown, including economic factors. A number of risks, uncertainties and other factors may cause actual results to differ materially from the forward-looking statements contained in this report, including, among other factors, those risk factors identified in our most recent Management’s Discussion and Analysis of Financial Condition and Results of Operations, under “Risk Factors” in our most recent Annual Information Form, and in our other filings with the Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission, all of which are available under our profile on SEDAR at www.sedarplus.ca and on EDGAR at www.sec.gov. Readers are cautioned to consider these and other factors carefully when making decisions with respect to Lightspeed’s subordinate voting shares and not to place undue reliance on forward-looking statements. Forward-looking statements contained in this news release are not guarantees of future performance and, while forward-looking statements are based on certain assumptions that Lightspeed considers reasonable, actual events and results could differ materially from those expressed or implied by forward-looking statements made by Lightspeed. Except as may be expressly required by applicable law, Lightspeed does not undertake any obligation to update publicly or revise any such forward-looking statements, whether as a result of new information, future events or otherwise.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.