Forecasting demand is essential for retailers to accurately predict how much of a product they should purchase. The inventory a retailer buys is directly related to your cash flow and, if you’re either carrying extra stock or not enough, you’re effectively losing money either through discounts or lost sales altogether.

One study found that retailers lose $1.1 trillion globally as a result of overstocks and out-of-stocks. To prevent over or understocking, you need to know when to reorder, how much to order and approximately how long it will take to sell.

One essential inventory metric to forecast demand is sell-through rate. With it, retailers can predict demand for a product and purchase the right amount from suppliers and manufacturers, avoid discounting and maximize profits.

In this article, we’ll cover the following:

- What the sell-through rate is

- Why you should measure sell-through

- Managing inventory via sell-through

- How to calculate sell-through rate

- What a strong sell-through rate is

- How to improve sell-through

- Sell-through vs. inventory turnover

- Limitations of sell-through

Need a purchase order template?

You’re in luck. Download our free purchase order template to help standardize your ordering process, ensure accurate record-keeping and save time.

What is the sell-through rate?

Inventory sell-through rate measures the amount of inventory a retailer sells in relation to the amount they purchased from a manufacturer. Generally speaking, retailers use sell-through rates to estimate how quickly they can sell a product and convert their initial investment into revenue.

Moreso than knowing how much and how quickly they’re selling a product, sell-through rates help merchants know how efficiently they’re turning over their inventory and avoid costs related to storage or discounting.

Why measure sell-through?

Calculating sell-through is an excellent way to measure the effectiveness of the merchandise you purchase from manufacturers or suppliers. It helps merchants understand how quickly products from certain manufacturers sell.

With that knowledge, merchants can make smarter inventory purchasing decisions and assure that they carry enough stock to meet demand while not carrying too much.

A business of any size can benefit from keeping tabs on sell-through. For instance, for larger businesses with multiple locations, large customer bases and higher expenses, avoiding excess inventory helps reduce costs across the board. Plus, you can better cater to your large customer base when you keep a consistent record of your sell-through though creating targeted marketing campaigns, promoting products and more.

Sell-through rate and inventory management

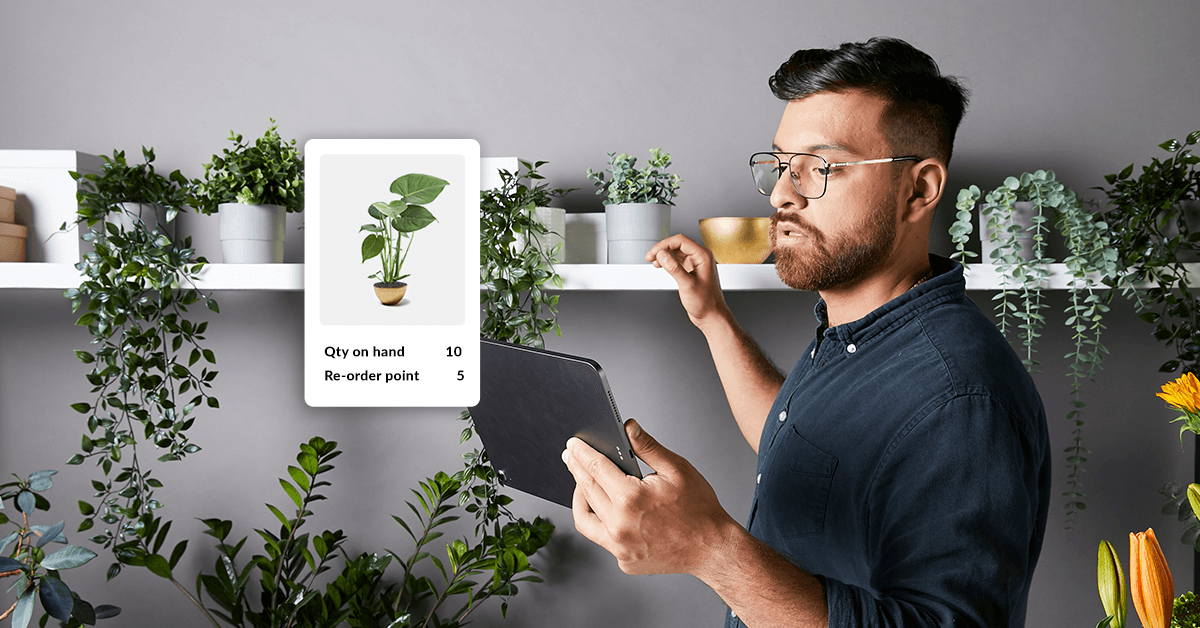

Inventory management is a delicate balance. If a retailer holds too much, they may have problems selling it all at full markup. If they don’t have enough, they might not be able to support demand from customers.

Sell-through rate can help retailers make adjustments to what products they buy based on how quickly they sell.

Retailers can calculate sell-through rates by product type, product category, brand, or any other category they choose from their retail POS system. Calculating the sell-through rate for any of these categories tells you whether investing in products (and what type of products, if you want to get that specific) from that manufacturer yields a fast ROI.

A high sell-through rate indicates that a retailer sold the inventory quickly in a given time period. Moving inventory fast and at full markup keeps gross profit margins as high as possible.

A low sell-through rate is an indication that a retailer isn’t selling those products as quickly as they expected. Inventory that doesn’t sell fast risks needing to be discounted, which impacts profit margins and lowers your ROI.

A product’s sell-through rate isn’t necessarily that black and white though. While it may indicate whether or not there was a strong demand from customers, it doesn’t reveal the causes. A product’s popularity is largely dependent on a number of factors: seasonality, style and the social currency known as hype.

A low sell-through rate won’t tell you why a product isn’t selling. To do that, you need to dig deeper, explore trends and get feedback from your customers.

How to calculate sell-through rate

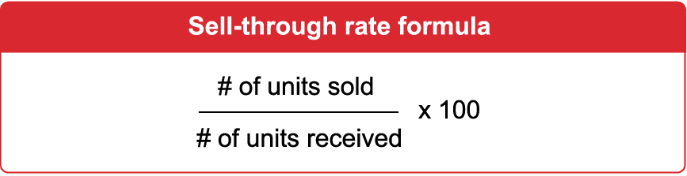

Sell through rate is calculated by dividing the number of units sold by the number of units received, then multiplying the sum by 100.

Most retailers calculate sell-through every 30 days. After 180 days of sitting on shelves or in the stockroom, that product is considered dusty inventory and should be discounted and sold to make room for new, seasonally relevant products that can be sold at full markup.

Sell-through rate formula

Sell-through rate example

Let’s say an apparel retailer buys 100 units of a specific brand of sweater. Within a month, the retailer sells 75 units. To calculate that sweater’s sell-through rate, the retailer does the following:

Sell-through rate = (75 / 100) x 100

Sell-through rate = 0.75 x 100

Sell-through rate = 75%

A sell-through rate of 75% in 30 days is a strong result. If the retailer wanted to improve that product’s sell-through in the future, they have several options.

What is a strong sell-through rate?

Sell-through rate is a good indicator of a business’s health. It serves as a simple snapshot into what a retailer is doing right when it comes to inventory and sales, and what may need improvement.

While the sell-through rate isn’t the only metric a retailer should use to calculate product demand and how much inventory will sell (more on that later), a consistent sell-through rate of 75% or more is considered strong.

Of course, seasonality, industry trends and other factors impact monthly sell-through, so fluctuations are perfectly normal.

But a rate consistently lower than 75% indicates a shake-up is required in order to improve sell-through.

How to improve sell-through

Looking at the earlier example, there are several ways the apparel retailer can improve sell-through for their sweaters, each with pros and cons.

1. Launch a promotion

While this option may be a tempting way to accelerate sales, be mindful that you’re lowering profit margins as a result. Promotions and discounts should be used sparingly and only when it makes sense to do so.

Let’s say the product is no longer in season or you only have a few, less popular sizes left. It makes sense to discount and sell those older products to make space for fresh inventory.

If, like the sweater example above, you’re selling those products at full price, but just not as quickly as you’d planned, perhaps the root of the issue is how much inventory you ordered in the first place.

2. Order less

If the merchant was expecting to sell through all their inventory of that sweater within 30 days, perhaps the issue is that they ordered too much to begin with. Had they purchased 75 units, their sell-through rate would be 100%.

Rather than purchase inventory based on gut instincts, consider researching the viability and popularity of a product before submitting a purchase order.

Monitoring sell-through, along with regularly monitoring the sales reports from their point of sale system’s backend, can result in better inventory purchasing. Rather than buy too much or too little, you can order the perfect amount to meet demand and keep your stockroom for fresh merchandise.

3. Factor in seasonality

Seasonal demand is essential to consider when attempting to improve sell-through. For the apparel retailer we used in our example, it makes sense that sweaters would sell fast closer to the winter months.

Retailers often sell seasonal merchandise a couple of months before the season actually comes around. Winter apparel, for example, would typically be sold in September or October. That means for our retailer, this would be a good time to sell sweaters at full price due to strong seasonal demand.

When demand for winter clothing decreases—typically in the latter half of the season—retailers try to clear stock to make room for new spring inventory. So our retailer would benefit from discounting the sweaters or implementing a promotion in order to improve sell-through.

4. Brand promotion

Increasing marketing and advertising efforts can make a world of difference in your sales. Use social media marketing tactics to increase brand visibility. That can include collaborating with an influencer or investing in paid social ads on platforms like Instagram or Facebook in order to enhance awareness.

Even just posting every day and utilizing features like Instagram Stories or Reels can drive more potential customers to your brand.

There are many brand awareness tactics you can employ to drive traffic to your website or store, and thereby improve sell-through.

Sell-through rate vs. inventory turnover

| Sell-through rate | Inventory turnover | |

| Definition | Percentage of inventory sold out of received stock | Number of times inventory is sold and replaced |

| Formula | (Units Sold / Units Received) x 100 | COGS / Average Inventory Value |

| Focus | Product-specific performance | Overall inventory management efficiency |

| Time Period | Typically shorter periods (e.g., weekly, monthly) | Typically longer periods (e.g., quarterly, yearly) |

| Use Case | Evaluating how fast new stock sells | Measuring how efficiently inventory is managed |

You may be wondering what inventory turnover is relative to sell-through. These terms are easy to confuse, but we’ll simplify it for you.

Inventory turnover is the rate at which a retailer has sold and replaced its entire inventory in a given time period, usually a year. A strong inventory turnover ratio is between 5 and 10—meaning that over the course of a year, between 50% and 100% of a retailer’s inventory has been sold. However, this depends on the industry a retailer is in and other factors, so the benchmark can vary. For instance, in some industries an inventory turnover rate between 4-6 is considered healthy.

Businesses calculate inventory turnover to determine whether they have a good level of inventory (aka, not an excessive level) relative to sales.

While the sell-through rate focuses on how much of your inventory sells in a period of time, inventory turnover rate calculates how fast inventory is sold.

To calculate the inventory turnover rate, you would take the value of cost of goods sold (COGs) for a certain period (let’s say a year) and divide that by the average value of inventory for the same period of time.

Inventory turnover rate example

Let’s say an apparel retailer’s COGs is $300,000 over a year, and the average value of their inventory over that same time period is $80,000. To calculate the inventory turnover rate, the retailer does the following:

Inventory turnover rate = (300,000 / 80,000)

Inventory turnover rate = 3.75

The retailer’s inventory turnover rate is 3.75, which is slightly below what’s considered a healthy ratio.

The limitations of sell-through

While the sell-through rate certainly gives merchants insights into how quickly products from certain manufacturers or suppliers sell, it’s important to note that forecasting demand cannot be done using that metric exclusively.

There’s a host of behavioral and qualitative factors that the best retailers also monitor regularly. For one, retailers should understand their customers, local market tendencies and overall trends in their space.

- Do customers shop seasonally or is the product in demand all year?

- What sizes, colors and fits are popular with customers?

- Do your customers have an affinity toward certain brands?

- Are your customers quick to jump on trends?

While some of this information can be found by digging into your sales reports, others necessitate that you stay informed by other means. For instance, the only way for an apparel merchant to know what the next trend will be is to both stay current with taste-makers and fashion trends and have a deep understanding of what their customers like. They can’t rely exclusively on their sales data.

For medium- to large-sized businesses, the sell-through rate is beneficial but it should be used in tandem with other methods and metrics. A multi-store or omnichannel business will have a larger, more complex customer base than one that is smaller or single-location. That means more data is needed to understand how to adjust inventory ordering, pricing, etc., to maximize revenue and reach full sales potential.

Use a mix of data, qualitative and anecdotal information from trusted sources when forecasting inventory demand to assure that you’re capturing the full scope of demand.

Forecast demand to improve cash flow

To maintain cash flow, a retailer needs to know when to reorder a product, how much to order and approximately how long it will take to sell. While some merchants rely on instincts alone, savvy retailers will dig into their sales reports and measure product sell-through, understand industry-wide trends and know what their customers like.

While it certainly takes more time to do it this way, it can work wonders for cash flow management. Knowing how much to purchase, how fast it will sell and how much they make on each sale enables retailers to predict how much money will come in and out of their retail business with greater accuracy.

Of course, having a point of sale system with inventory forecasting capabilities like Lightspeed helps. Talk to our team of retail experts today to learn about our platform’s advanced inventory management today.

FAQs about sell-through rate

What is the sell-through rate?

The sell-through rate (STR) is a metric used in retail to measure the percentage of inventory sold within a specific time period compared to the amount of inventory received. It helps retailers understand how well products are performing in terms of sales.

How is the sell-through rate calculated?

The sell-through rate is calculated using the formula:

Sell-through rate (%) = (Units Sold / Units Received) × 100

For example, if a retailer received 100 units of a product and sold 60 units, the sell-through rate would be:

(60 / 100) × 100 = 60%

What is considered a good sell-through rate?

A “good” sell-through rate varies by industry, product category, and sales cycle. In general, a sell-through rate of 60-80% is considered healthy. Anything above 80% may indicate strong demand, while below 40% could signal that a product is underperforming or overstocked.

How often should I calculate sell-through rate?

Sell-through rate can be calculated on a weekly, monthly, or quarterly basis depending on the nature of your business and the product lifecycle. High-turnover industries, such as fashion, may benefit from more frequent monitoring.

What’s the difference between sell-through rate and inventory turnover?

While both metrics measure sales performance, the sell-through rate focuses on the percentage of inventory sold over a specific period, while inventory turnover measures how many times inventory is sold and replaced within a period. Sell-through is often used for individual products, while inventory turnover applies to overall inventory.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.