With careful budgeting, tracking and accounting, most businesses do just fine managing their operating expenses. But you can go a step further to optimize your budget and employ several different measures to reduce operational costs.

Operating expenses defined

Operating expenses, referred to as OPEX, are the essential costs involved in running your business on a day-to-day basis. These expenses include rent, utilities, marketing and payroll, among many others.

You can learn more about OPEX in our in-depth guide.

Ultimately, it never hurts to cut costs across your business where possible to improve your cash flow. Operating expenses encompass a large portion of those costs, and when you implement even a few cost-reduction methods, it can make a huge impact on your bottom line.

In this article, we’ll go over 12 ways to reduce operational costs:

- Use cloud-based solutions

- Re-evaluate vendor terms and contracts

- Incorporate sustainable practices

- Utilize data-driven decision making

- Optimize inventory

- Conduct regular check-ins

- Establish clear expense protocols

- Cancel unused services and subscriptions

- Adjust working hours

- Pay invoices early

- Keep your employees happy

- Promote cross-training and multi-tasking

Our free guide will help you understand the kind of point-of-sale system you need to run your business efficiently.Searching for the right POS system?

1. Embrace cloud-based solutions

Nowadays, businesses of every size have access to premium software and systems that can completely streamline their operations. By going to a provider that offers all-in-one cloud-based solutions with features including point of sale, payment processing, accounting, inventory management and more, you can save money and time. With all your needs covered under one flexible solution, you can run your business much more efficiently. You’ll save money when you aren’t tied to multiple vendors, such as one for POS and one for payments.

By embracing technology, you won’t need to allocate as many resources to other operational expenses like labor or paying for ongoing services. Instead, important tasks are automated and data is collected in one place. When your workflows are streamlined, you can focus on sales and invest more time in improving your revenue streams.

For instance, Lightspeed customer Maynard helps us understand what this can look like in action. The farm-to-table restaurant’s operations are inherently complex, with as many as a dozen suppliers. They also have to balance the business’ quick-service atmosphere with its fine-dining style food. “It’s a lot of juggling, a lot of coordination, and a massive amount of effort,” says restaurateur Brodie Somerville.

To make their operations more efficient, the business uses Lightspeed Restaurant, Payments, Delivery and other features. This way, Somerville can easily keep track of suppliers and streamline the menu, and it’s made handling deliveries much simpler. “Saving two minutes by not having to manually input a delivery order really adds up if you’re getting 100 delivery orders a day.”

2. Re-evaluate vendor terms and contracts

It’s helpful to audit your contractual relationships with vendors and suppliers. Could you be getting a better deal somewhere else? Basically, it never hurts to shop around for suppliers that meet your business needs at a better price. Likewise, you can negotiate contracts with existing vendors if you have strong relationships that you don’t want to shift away from.

3. Incorporate sustainable practices and minimize waste

You can cut costs and shrink your carbon footprint at the same time when you implement sustainable practices into your business. That can include:

- Consulting your utilities provider to identify ways you can lower your utilities costs

- Carrying out low-cost repairs like broken or cracked windows and loose caulking

- Cleaning radiators and other equipment

- Reducing unnecessary packaging

- Getting rid of unnecessary waste (unused supplies, equipment, etc.)

- Buying the right amount of inventory (instead of over-purchasing)

Not only will you improve your impact on the environment, you’ll save money in the process.

4. Take advantage of data-driven insights

These days, data is currency. You can use data to make high-level decisions and gain insight into areas of the business where you can reduce spending. For instance, if you have insight into what products are selling most month-to-month and what’s not performing well, you can adjust your inventory accordingly. Instead of allocating part of your budget to pay for inventory that may not be sold, you can instead focus on more popular products, ultimately saving money and selling more.

Let’s take a look at Lightspeed customer Kotsu Ramen & Gyoza, which uses Advanced Insights to make data-driven decisions.

Chief concept officer Grant Macdonald says Lightspeed Restaurant allows them to view how much particular items are selling, and which ones are fueling repeat orders.

“You can look at the item and say, ‘I love this item. It sells really well. But you know what? People come here and they try it and then they don’t come back. Or this item I didn’t think was a big deal. But the customers that come for this, they love it. They come back over and over again’. That kind of data drives really good decisions about what needs to be on our menu, what belongs there, and what makes sense,” adds Macdonald.

This is just one example of how data can truly change the way you operate your business, and in turn improve cash flow.

5. Optimize inventory management

Data can unlock new, inventory-related insights. But that accompanied with a good system for managing and tracking inventory can change the game for your business.

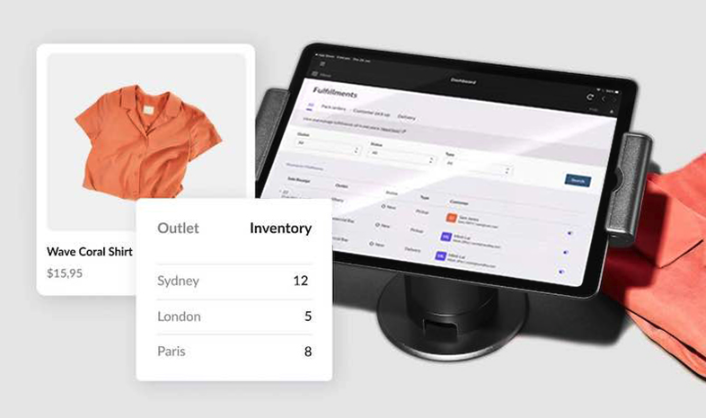

Inventory management systems can significantly reduce operational costs for your business. They generate reports, cut paperwork and give you a full view of your inventory, allowing you to make more informed inventory-related decisions.

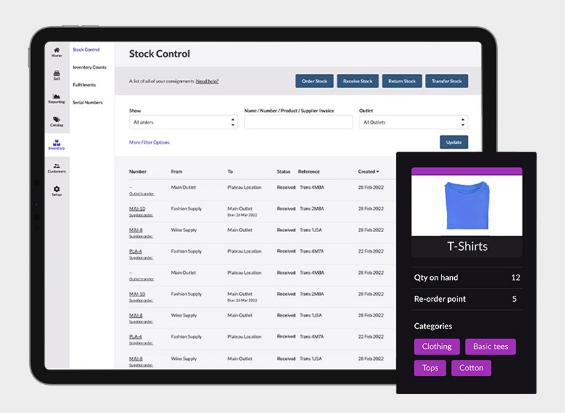

A cloud-based program like Lightspeed Inventory Management allows you to easily manage inventory across all your business channels.

You can use it to order stock, manage purchasing and deliver special orders.

Plus, you can prevent popular products from going out of stock with alerts and take advantage of inventory counting tools.

These are just a few of the ways that inventory management software can help cut costs. By computerizing such an essential aspect of your business, you can more easily keep track of your inventory budget and optimize the way you allocate resources.

6. Conduct regular check-ins

Usually an outside party will conduct an expense audit on your business. These are necessary to ensure that you’re correctly keeping track of your expenses. To help that process run seamlessly, keep a detailed system that tracks your daily and monthly operational expenses. Conduct frequent checks to pinpoint unnecessary expenses. Not only will you understand your expenses better, you’ll ensure that they are accurately recorded and reasonable compared to your cash flow.

7. Establish clear expense policies

Does your company often cover expenses like business travel, food, etc., for employees? If so, you may want to consider creating a clear policy document that outlines how much employees can spend per day, travel budget limits and other relevant information. This will establish clear boundaries for how company funds are allocated toward expenses, likely saving you money in the long run.

8. Cancel unused services and subscriptions

Monthly subscriptions for unused apps and services can add up and eventually make a sizable dent in your operating expense budget, without you noticing. For that reason, it’s important to offload these expenses, especially if you’re making automatic payments. Take a close look at your statements to check which services you don’t use. It could potentially save you thousands!

9. Adjust working hours

Depending on the kind of business you run, it could be beneficial to reevaluate your working hours to save on utilities and billed hours. For example, if you operate a bricks-and-mortar store that sees seasonal fluctuations in sales, consider adjusting your operating hours. You could potentially save money on the many expenses associated with keeping your store open when it’s not busy. This could be a big change for both your employees and customers, so do your due diligence, talk to your employees and make sure the savings would be worth it before you make the jump. Keep your customers informed and in-the-loop as well. You could even use the opportunity and potential savings to improve your online platform and drive more business there.

10. Pay invoices early

Did you know that vendors and suppliers often offer discounts to the businesses they work with if they pay their invoices early? These discounts can range from 2% and more. Look into the vendors and suppliers you use and get in touch with them to confirm that they offer such discounts. You’ll save money in the long run.

11. Keep your employees happy

According to a 2022 McKinsey report, around 20% of the US workforce is employed in the retail and hospitality sector. Further, the turnover rate for retail employees has been at around 60% or higher for years. The hospitality industry is also notorious for high turnover rates. That’s something that retailers and restaurants everywhere need to improve.

It’s simple: the better you treat your employees, the more likely you are to retain them. Plus, you could see higher productivity rates, which can positively impact your bottom line. Employees will probably be more productive when they work in an environment that’s encouraging, well-paying and where they feel heard and protected.

Equally important is gathering feedback from your employees about processes around your business. Employees are embroiled in the day-to-day tasks that you aren’t always there to witness, and they can tell you where they can save time, how to make procedures more efficient and other valuable information. Most important, incorporating their feedback and recommendations will ensure that they feel heard by their employer.

The investment in your employees could pay off in a big way. The higher your turnover rate, the more time and resources you’ll have to spend on hiring and training new employees. It’s simply not a long-term solution, and can make a significant dent in your cash flow.

12. Promote cross-training and multitasking

Other contributors to employee productivity include cross-training and multitasking. Cross-training is when an employee trains another on a set of skills they didn’t previously have. This will help cover knowledge gaps in all areas of the business. You’ll get a significant return on investment while reducing operating expenses associated with training employees from scratch and hiring more staff.

Further, with cross-training comes the ability to multitask. As we stated above, it’s important to gather feedback from employees to see which areas you can make drive efficiency and ultimately reduce costs overall. Your employees will have first-hand knowledge of this, including the areas where they can multitask to ultimately make tasks go by faster.

Lastly, you can also consider flexible staffing: during busier seasons, you can employ seasonal staff. Or, depending on the nature of your business, consider hiring freelancers and contract workers to fill any gaps in your business without committing to full-time hires if you don’t need them.

Reduce operational costs across your business

At the end of the day, you know your business best. Operational costs vary across every company, but these suggestions are completely adjustable to the size and needs of your business. It’s easy to get lost in the daily grind of tracking and paying operational costs, but by implementing different measures, you can easily stay ahead of these costs and ultimately lower them.

Additionally, the platform you use to run your business can change the way you address your operational expenses.

If you’re interested in running your business more efficiently using a solution like Lightspeed, talk to one of our experts today.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.

![11 Tips To Make Your Pop-Up Shop a Roaring Success [For Retail Store Beginners and Pros Alike]](https://blog-assets.lightspeedhq.com/img/2021/06/2da3ae10-blog-hero_pop-up-shop.jpg)