Whether they’re clicking ‘buy’ from the couch or checking out in-store, shoppers today just want a seamless experience where they can pay exactly how they like without hitting a single snag. But all too often, businesses are dealing with fragmented payment systems, siloed customer data and inconsistent checkout experiences that frustrate customers and reduce conversion.

Disjointed systems for in-store and ecommerce sales build data silos. A unified approach ensures a consistent brand experience and streamlines backend reconciliation.

In this blog, we’ll go over how omnichannel payments can make a different:

- Omnichannel vs multichannel payments

- How omnichannel payment processing works

- Core features and functions of omnichannel payments

- Omnichannel payment channels

- Types of payment methods in omnichannel systems

- Why omnichannel payments are important to businesses

Grow your retail business.

Streamline inventory, suppliers, teams and stores with Lightspeed's all-in-one platform. From intuitive POS and stock management features to powerful reporting, Lightspeed gives you the tools you need to grow.

Key takeaways

- Omnichannel payments bridge the gap between digital and physical commerce by integrating every transaction point into a single, centralized platform.

- Unlike multichannel models that trap data in silos, omnichannel systems unify your streams so inventory and sales figures update everywhere at once.

- This centralized approach provides a 360-degree view of your revenue while giving shoppers the total flexibility they expect.

- A smoother checkout process keeps customers happy, reducing cart abandonment and fostering long-term loyalty.

- These unified insights make it easy to optimize your stock levels and create marketing that feels personal to every customer.

Omnichannel vs multichannel payments

In all the buzz, sometimes multichannel strategies are mixed up with true omnichannel integration.

Multichannel simply means accepting payments on different platforms that operate in isolation. You might have a card terminal in your shop and a checkout page on your website, yet the two never communicate.

Omnichannel payments unify touch points into a single ecosystem. Data flows instantly between your physical POS and ecommerce site. If a customer buys a shirt online, inventory updates everywhere immediately.

As an example, think about the return process. With a multichannel setup, an in-store associate cannot easily refund an online purchase because the associate lacks access to transaction data. An omnichannel system pulls up order details on the register instantly to process the refund. You stop wasting time on manual reconciliation and gain a clear view of business performance.

How does omnichannel payment processing work?

Omnichannel payment processing is the central nervous system for retail operations. The system integrates payment gateways, merchant accounts and POS software into a single synchronized loop. A transaction on one channel immediately updates data across every other channel.

To illustrate, let’s look at how omnichannel payments would work using Lightspeed POS.

Unified transaction capture

A customer starts a purchase with a preferred method, like a credit card, mobile wallet or buy now pay later option.

The payment terminal or digital checkout captures payment details and converts the numbers into a secure token. Tokenization protects sensitive data and allows the system to recognize the card later.

The gateway transmits the token to the acquiring bank and card networks for validation. Validation happens in milliseconds to minimize friction. Once the issuer approves funds, the processor confirms the sale and routes money to the merchant account.

Instant inventory and data updates

A completed transaction triggers an automatic update across the inventory management system. The software instantly deducts sold items from the master inventory record. Real-time synchronization prevents a customer in a physical store from buying an item someone else just bought online.

You maintain accurate stock counts across multiple locations and warehouses without manual intervention. The platform records revenue in the central ledger immediately to ensure accurate financial reporting.

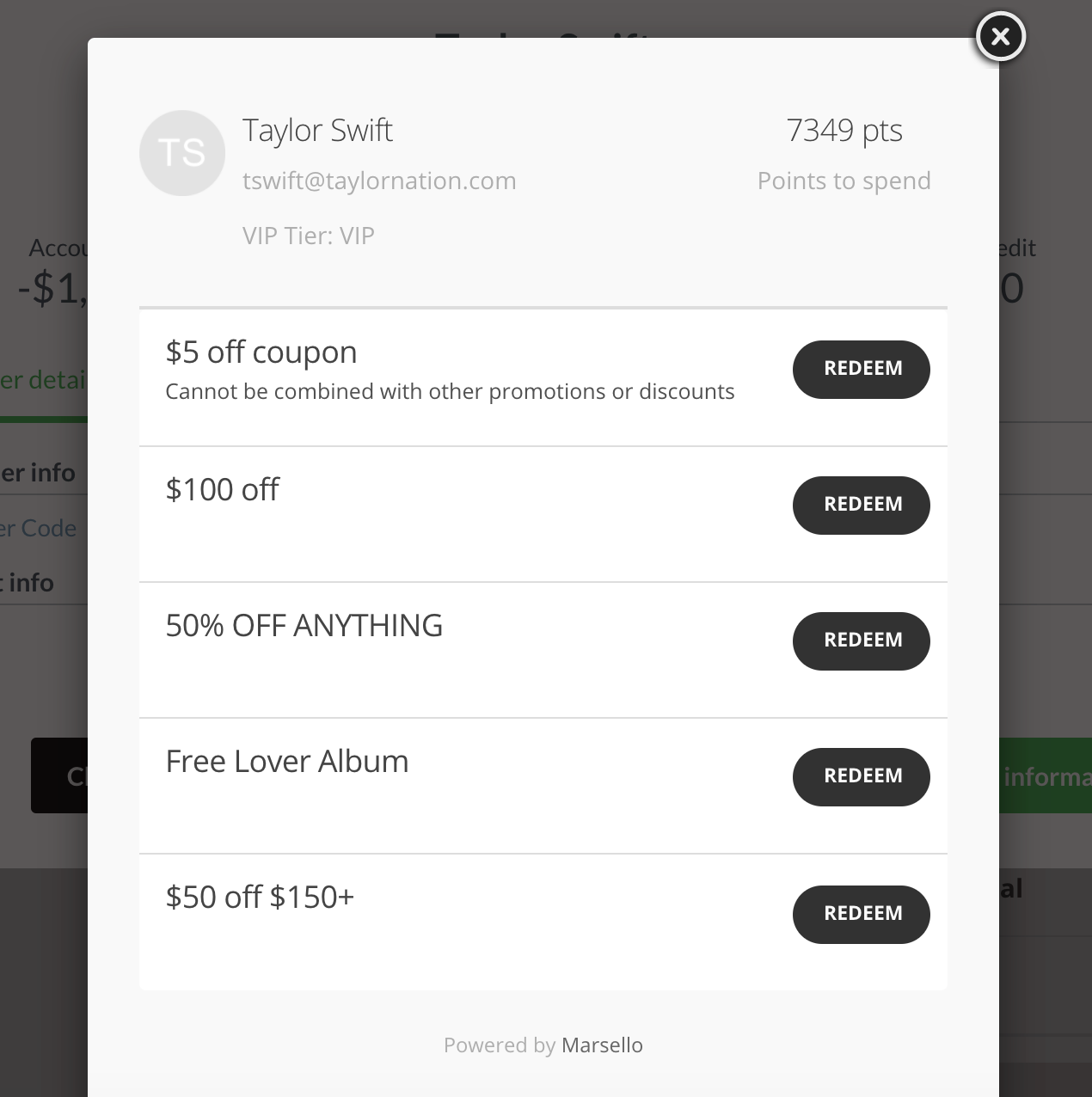

Customer profile enrichment

Transaction data automatically attaches to a customer’s profile in the database. The system updates loyalty points and purchase history to reflect new activity.

Loyalty points automatically update in Lightspeed.

You can use the aggregated data to create personalized marketing campaigns based on actual shopping behavior.

Staff members can view the history at the register to offer personalized recommendations. The customer receives a consistent experience whether they shop on a phone or visit a flagship location.

Simplified reconciliation and returns

All transaction data flows into a single reporting dashboard. You no longer need to match batch reports from different providers to close the books. A unified data stream simplifies end-of-day reconciliation and reduces administrative errors.

Centralized processing enables seamless returns and exchanges regardless of where the original purchase occurred. A staff member can pull up an online order on the store register to process a refund or exchange. Flexibility eliminates friction and improves the overall customer experience.

Core features and functions of omnichannel payments

An omnichannel payment system is the central hub for your business. Instead of juggling multiple provider portals, you manage every transaction stream from a single dashboard.

Real-time data and analytics

Real-time synchronization means inventory counts update the moment a sale happens online or in-store. Analytics tools take the raw numbers and reveal peak sales hours or high-performing products across all locations. Accurate stock levels prevent overselling and keep your customers happy.

Advanced security and compliance

Security is non-negotiable when you accept payments across multiple touchpoints. Advanced tokenization replaces sensitive card numbers with unique codes to reduce fraud risk and simplify PCI DSS compliance. The technology protects your business and builds trust with your clientele.

System integration

Integration with CRM and ERP systems allows you to track customer behavior and manage resources. You can build detailed shopper profiles to personalize campaigns and drive retention. Connected systems ensure every department operates with the same accurate information.

Omnichannel payment channels

Customers interact with your brand in many ways, and the backend needs to keep up. An omnichannel payment platform centralizes the data so transaction history stays consistent.

Here is how the channels function within a unified ecosystem.

Online and mobile commerce

Ecommerce sites and mobile apps are your 24/7 storefronts.

Speed is what drives conversion here. Shoppers look for digital wallets and one-click checkouts that use stored tokens for security. You capture sales instantly, and the system syncs inventory across the network.

Mobile apps are even more integrated. Customers verify transactions with a fingerprint or face scan—no friction. Sales data feeds directly into reporting tools to inform stocking decisions.

In-store point of sale

Physical locations use modern POS terminals to accept chip cards, magstripes and contactless payments like NFC. Mobile POS devices let staff process transactions anywhere on the floor. Mobility turns the checkout into a fluid interaction.

Modern terminals also support endless aisle transactions. Using Lightspeed, employees can special order out-of-stock items for home delivery right from the screen, making sure you never miss a sale.

Hybrid purchasing models

Strategies like buy online, pick up in store (BOPIS) are the bridge between digital convenience and immediate gratification. A customer pays via the website. A store associate receives instant verification to fulfill the order. The system reconciles revenue with the location’s inventory automatically.

B2B and direct billing

Wholesale and B2B transactions often need invoicing, recurring billing or net-term arrangements. Integrating complex payment flows ensures the general ledger reflects high-volume orders alongside retail sales.

Types of payment methods in omnichannel systems

To capture every sale, your system must handle specific payment categories.

Card-present transactions are exactly what they sound like. The customer physically interacts with your POS terminal using EMV chip cards or magnetic stripes. Contactless methods like NFC fall here too—think tapping a card or phone against the reader.

Card-not-present transactions power your ecommerce and remote operations. We are talking about standard online checkouts, recurring billing for subscriptions and orders placed over the phone. You cannot inspect the card physically. Strong fraud detection protocols are a requirement to prevent chargebacks.

Digital wallets tokenize payment data for instant approval. Buy now, pay later (BNPL) services split costs over time. Direct bank transfers and real-time payment systems are smart additions as well. They offer lower fees and faster settlement for high-value orders.

Omnichannel payments are important to business, because they’re important to shoppers

Shoppers expect to move between online browsing and in-store purchasing without hitting a wall. An omnichannel payment strategy removes the friction points that lead to lost sales. You secure revenue and build loyalty when the experience is consistent across every channel.

Centralized transaction data gives a complete view of how the business performs. You eliminate manual reconciliation work and gain clear insights into customer preferences. Real-time reporting helps you make smarter inventory and operational decisions.

Ready for your payments to go truly omnichannel? Talk to an expert to learn how Lightspeed can help grow your business.

FAQs on Omnichannel Payment

What is the difference between omnichannel and multichannel payment?

Multichannel payments operate in isolation, but omnichannel systems integrate every transaction into a single data stream. The result is real-time inventory updates and consistent customer profiles across online and physical stores.

What are the main benefits of omnichannel payments?

Centralized processing eliminates manual reconciliation errors and provides a complete view of business performance. You capture more revenue by offering flexible purchasing options like buy online, pick up in store to reduce friction.

Is omnichannel still relevant in 2026?

Omnichannel strategies are the retail standard because shoppers demand seamless transitions between digital browsing and physical purchasing. Businesses that fail to integrate channels risk losing market share to competitors who offer unified experiences.

What are examples of omnichannel payment channels?

Common channels are in-store POS terminals, mobile apps and ecommerce checkout pages that all feed into one merchant account. Advanced setups also incorporate social media buying links and endless aisle kiosks to capture sales anywhere a shopper engages.

How does omnichannel payment help customer experience?

Unified payments allow shoppers to buy, return or exchange items on their preferred channel without administrative hurdles. Access to cross-channel purchase history enables staff to provide personalized recommendations that drive loyalty.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.