Owning a restaurant is a dream for many businesspeople.

Yet, the day-to-day costs of opening and running a restaurant can make owners think twice about doing so.

Whether you’re a talented chef, local entrepreneur or a seasoned restaurateur opening new locations, restaurant financing can be one way to help bring the dream to life.

That’s why in this article, you’re going to learn:

- What restaurant financing is

- What to do before you apply for financing

- Why restaurants apply for financing

- 10 restaurant financing options

- How to compare financing options

Let’s dive right in.

Run your restaurant with Lightspeed POS and Payments. Create custom floor plans and menus, take tableside orders, accept payments and manage your whole business from one intuitive platform.Your POS system is your restaurant's heartbeat

What is restaurant financing?

Restaurant financing refers to any form of outside funding that business owners secure to support a range of business needs. This could be a bank loan, funds from family and friends, investors or other lending sources.

What to do before you apply for restaurant financing

Write a business plan

When you’re starting or buying a restaurant, you need a business plan that outlines your objectives and how you plan to get there.

Not only will this document help you strategize your way towards paying down your loan and creating an economically viable restaurant but, in many cases, a written business plan is required when applying for funds. Get ahead of the curve and make this your first step before you even seek financing.

The same goes for if you’re expanding your business to new locations.

Determine how much financing your restaurant will need

The cost of buying or opening a restaurant can range from thousands to millions of dollars depending on the location, size, restaurant type and other factors. Even if we assume that the price is reasonable to you and you’re willing to take out financing to help pay for it, the exact amount will help dictate what kind of loan you need to apply for and what the terms will be.

Why do restaurant owners apply for financing?

There’s a host of reasons why restaurant owners and finance teams look for funding in the first place.

- Starting a new business

- Renovating an existing location

- Purchasing an already-established restaurant

- Investing in new equipment

- Opening another location

- Adding more tables to increase covers

- Operations, marketing or hiring advice

- Rebranding

- Diversifying through catering and packaged goods

- Funding operational expenses

Starting a new business

There are plenty of startup costs to plan for before a restaurant can open its doors to the public. Owners might need to refurbish premises, update old kitchen equipment, buy furniture and fittings and invest in menus and staff uniforms. And let’s not forget the need to carefully source that all-important food, alcohol and beverage stock.

Renovating an existing location

As successful restaurants evolve, many chefs and owners seek to hire more experienced kitchen staff or redesign their interiors. Interior design trends change rapidly, especially in metropolitan areas. What’s more, busy restaurants can quickly experience wear and tear because of the sheer number of customers coming through the doors each day. While it’s a good problem to have, it does mean regular renovations become a reality.

Purchasing an already-established restaurant

Purchasing an already-established restaurant can be a great thing—your customer base is likely already built in. However, there are a few things you should ask before deciding to purchase a business.

- Why is this restaurant for sale? Unless you’re making the owners a ridiculous offer, they’ll have their own reasons for wanting to get out of the business. Those reasons might be personal—family obligations, burnout—or they might be related to the health of the business. If it’s the latter, decide whether you have the skills to transform the restaurant before you buy.

- Is the restaurant in a good location? A restaurant’s location can be the single biggest reason why it succeeds or fails. If the restaurant is doing well, do some research to see just how much of its success is due to factors other than location. If the restaurant is coasting off of discounts, deals or recent media exposure rather than building a sustainable loyal customer base, your reign might be a short one.

- What’s the cash flow situation? You need a true understanding of the restaurant’s finances before you buy, which means examining its cash flow. Restaurants are known for having low margins, but are those margins, at the very least, consistent? Will you eventually find yourself taking out additional financing to cover payroll if you have a slow month? The cash flow picture for a restaurant should include overhead costs, such as rent, utilities, insurance, and taxes, as well as labor costs, food costs, check averages and food and beverage sales. If the current owner is reluctant to show you the books, that’s a red flag.

- Does the restaurant have any lingering liabilities? Be sure to investigate any liabilities attached to the business, such as health code violations, lawsuits or unpaid sales tax. You don’t need to inherit any outstanding debts on top of what you’ll owe yourself.

- Is the equipment in good condition? A restaurant’s equipment is the heart of the business. Not only are assets like refrigerators, commercial ovens and food preparation equipment vital to the success of a restaurant, they’re also typically quite expensive and difficult to replace or fix on the fly. Before agreeing to buy a restaurant, have an expert inspect the equipment.

Investing in new equipment

Whether it’s chefs, waitstaff, or baristas—everyone needs the right tools to do their jobs. For this reason, many owners look to equipment financing to help fund the restaurant equipment they’ll need, from coffeemakers, a POS system and premium ovens, to grills and stoves.

Opening another location

Expansion is another common reason why owners explore their restaurant financing options. Many entrepreneurs have bold plans to grow from a single location into either a chain of city-wide or regional restaurants. Doing so comes with costs related to sourcing new commercial spaces, handling renovations, paying operating expenses or even constructing a new building.

Adding more tables to increase covers

But not all expansion plans need to be so grand. Much like their chefs who carefully add an ingredient here and there to ensure a perfect taste, restaurant owners may look to change their business more slowly. Expanding can involve something as simple as adding space to serve additional ‘covers’ on new tables.

Operations, marketing or hiring advice

Restaurant owners have to make many decisions every day, often against the backdrop of the hustle and bustle of a busy restaurant. It’s understandable that many owners choose to get some outside advice. There is an increasing number of consultants—some who own or chef in other restaurants—who have begun to provide advice to other restaurant owners. Such consultants can help with sourcing managers or sous chefs, give advice about how to position a restaurant in a crowded market or help to improve the overall running of the business.

Rebranding

Restaurant owners know the industry is highly competitive. In fact, many thrive on it.

Still, it can be a challenge for restaurants serving highly popular cuisines—in French bistros, Italian pizzerias and Japanese ramen spots—to stand out from competitors offering similar dishes and experiences. It’s here where the value of a restaurant’s brand can become a key point of difference. Some restaurant loans are being used to create standout brands or to rebrand traditional venues for emerging culinary and dietary tastes.

Diversifying through catering or packaged goods

One way restaurants can build a strong brand is by continuing customers’ experiences with them beyond the building. Here’s where providing catering services and take-home products can play a part.

Many grills are famous for their steak and rib sauces. Italian restaurants have home-made pasta that’s impossible to recreate yourself. And some Asian restaurants have frozen dumplings that can—for a few fleeting moments—whisk your tastebuds back to that favorite restaurant.

While providing these goods can provide an additional revenue stream for restaurants, they do come with the costs of product development, packaging and logistics.

Funding operational expenses

Seeking funding is not always about growth. On other occasions, owners pursue restaurant funding options to support the day-to-day running of the business. In restaurants where revenue is seasonal—or even unpredictable—some owners may decide to secure funds to support positive cashflow.

10 restaurant financing options

Now that you’ve learned about some of the reasons for restaurant lending, here are 10 different financing options you can consider:

- Brick-and-mortar bank loans

- Alternative loans

- Small Business Administration loans (SBA)

- Merchant Cash Advances (MCA)

- Business line of credit (LOC)

- Business crowdfunding

- Loans from friends and family

- Commercial real estate loan (CRE)

- Equipment financing

- Purchase order financing

For a fast overview of how these restaurant financing options stack up against one another, consult the table below.

| Brick-and-mortar bank loans | Alternative loans | Small Business Administration loans (SBA) | Merchant cash advances (MCA) | Business line of credit (LOC) | Business crowdfunding | Loans from friends and family | Commercial real estate loan (CRE) | Equipment financing | Purchase order financing | |

| Interest Rates | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies | Varies |

| Collateral Requirements | Yes | Varies | Yes | No | No | No | No | Yes | Yes | No |

| Approval Process | Can be lengthy | Can be quicker | Can be lengthy | Quick | Quick | Can be lengthy | Quick | Can be lengthy | Can be lengthy | Quick |

| Repayment/Remittance Terms | Varies | Varies | Varies | Fixed | Fixed | Varies | Varies | Varies | Varies | Varies |

| Eligibility Requirements | Good credit, strong financials | Varies | Good credit, strong financials | Business must generate revenue | Good credit, strong financials | Varies | None | Good credit, strong financials | Good credit, strong financials | None |

| Best For | Established businesses | Businesses with less-than-perfect credit | Established businesses with strong financials | Businesses with short-term cash flow needs | Businesses with ongoing cash flow needs | Businesses seeking funding for specific projects | Businesses with limited access to traditional financing | Businesses purchasing commercial real estate | Businesses purchasing equipment | Businesses fulfilling large purchase orders |

Now, let’s dive into more detail about the pros and cons of all 10 options for sourcing funds.

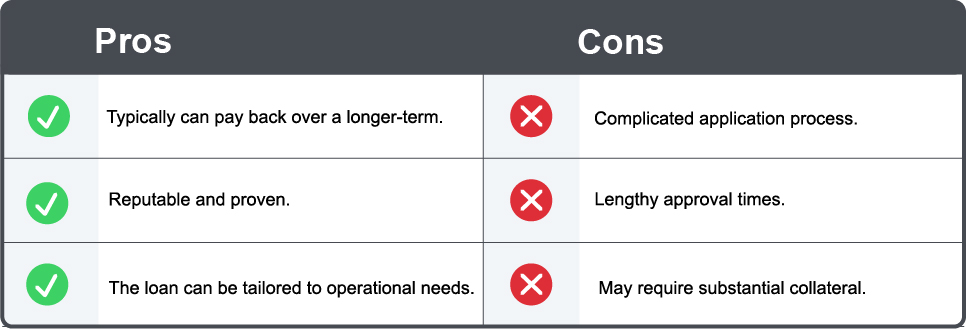

1. Brick-and-mortar bank loans

Let’s start with probably the most well-known option: your bank. Traditional banks have been lending to small to mid-sized businesses for a very long time. Their systems are established, rigorous and proven. Let’s take a quick look at the pros and cons of seeking finance through a bank.

Are bank loans right for your restaurant?

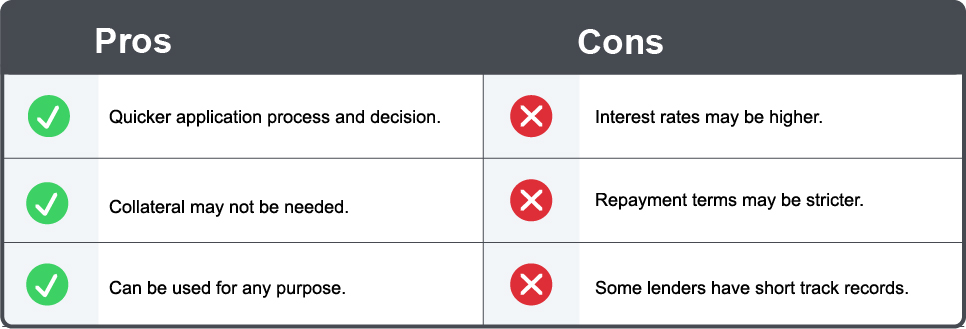

2. Alternative loans

Understandably, not every restaurant owner has the time or occasionally the credit history to secure funding from a brick-and-mortar lender. In these situations, loans for restaurants can be pursued with a number of alternative lenders. Here are some points you might want to consider when looking into an alternative loan option.

Are alternative loans right for your restaurant?

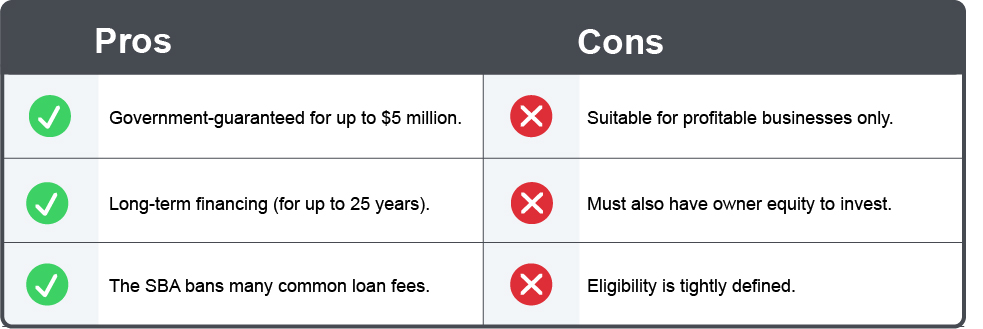

3. Small Business Administration (SBA) loans

SBA loans help existing small businesses when they can’t get financing from other sources or without an SBA guarantee for the lender. The SBA does not fund these restaurant loans directly. It guarantees banks it will repay a portion of the loan if a business defaults.

SBA loans may be used to buy land or equipment, buy an existing business, refinance existing debt, or purchase machinery, furniture, fixtures, supplies or materials.

Is an SBA loan right for your restaurant?

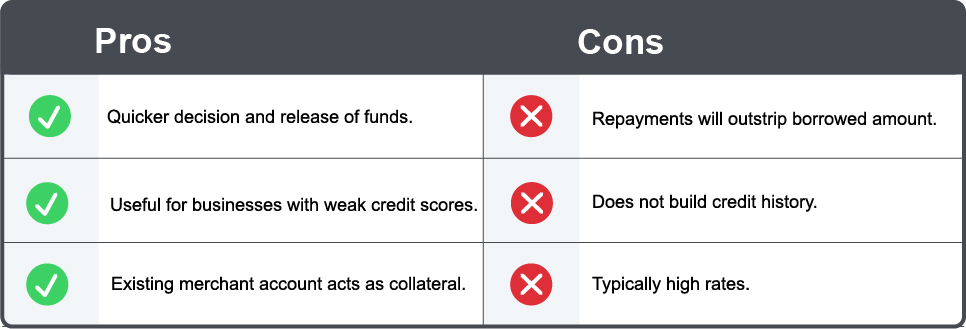

4. Merchant cash advance (MCA)

Technically not a loan, a merchant cash advance (MCA) is a way for restaurants to receive funds against future payments that will be made through their merchant payment system.

This can be useful for restaurants that are processing a high volume of credit card transactions while needing access to funds—fast. However, the rates of some MCA providers can lead to repayment amounts outstripping the original advance by as much as 40%.

Point of sale partners like Lightspeed also offer merchant cash advance options for their customers. Lightspeed Capital takes away the roadblocks many restaurant owners face on their search for funding. With a cash advance offer that’s tailored to your business, you’ll be able to grow your restaurant, maintain cash flow and finance new projects. It’s fast, convenient and secure funding that you can receive in as soon as two business days.

For Lightspeed customer and restaurant collective Dabangg Group, Lightspeed Capital is crucial to their growth. They used their cash advance to invest in modern hardware.

“When it comes to opening a restaurant, there are a lot of overhead costs and capital assets we need to inject into the new sites. So, when Lightspeed Capital came in, that helped us maintain the infrastructure and invest in new systems.” said purchasing manager Joju Shibu.

Is an MCA right for your restaurant?

Get an in-depth understanding about merchant cash advances in this article.

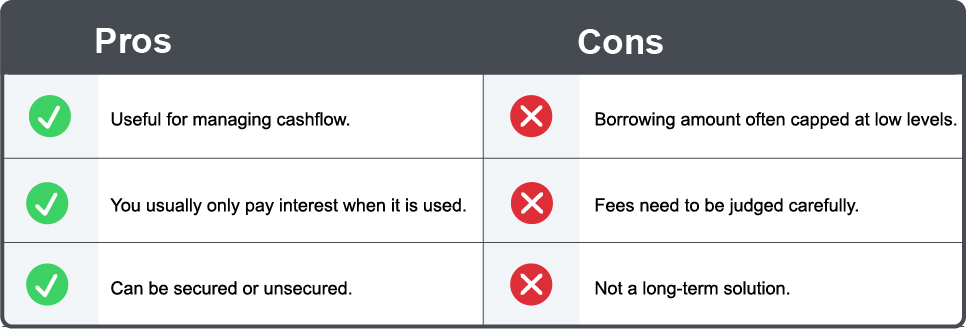

5. A business line of credit (LOC)

Businesses usually seek out lines of credit through their bank. Many alternative lenders are now offering this option too. In short, a business line of credit allows restaurants to access a set additional amount of funds each, as and when needed. Larger businesses especially often pull funding from a LOC.

Is a business line of credit (LOC) right for your restaurant?

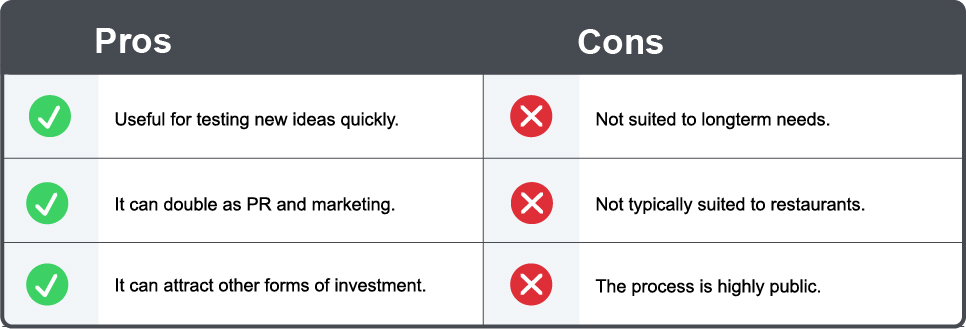

6. Crowdfunding

Crowdfunding is the use of small amounts of capital from a large number of individuals to finance a new business venture, according to Investopedia. Crowdfunding is often used to validate new product ideas or seek funding from early adopters for a new startup idea. It’s less associated with service businesses, particularly restaurants. Still interested? Here are some of the pros and cons. It’s not the most common method of funding, and is usually a last resort for entrepreneurs who are looking for funding.

Is crowdfunding right for your restaurant?

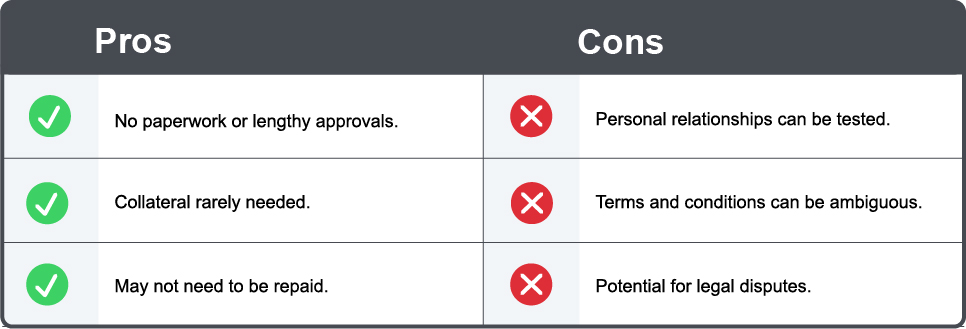

7. Friends and family

If you’ve been running a restaurant for a number of years, your friends and family are likely some of your biggest supporters. They may have backed you as a business owner and dug into their own pockets, as your earliest and subsequently most loyal patrons.

It makes sense then. This is why many business owners choose to ask parents, siblings, partners and friends for financing. They can help chefs and restaurant-owners get working capital through a loan without a credit check. Just remember: mixing professional and personal relationships can become complicated.

Is a loan from family and friends right for your restaurant?

8. Commercial real estate loan (CRE)

Commercial real estate isn’t getting cheaper any time soon. Restaurateurs can tap into commercial real estate (CRE) loans to improve buildings, parking lots, gardens and more. Some lenders, particularly those participating in SBA schemes, may allow borrowers to include architectural and legal fees, appraisals and other construction costs within a loan.

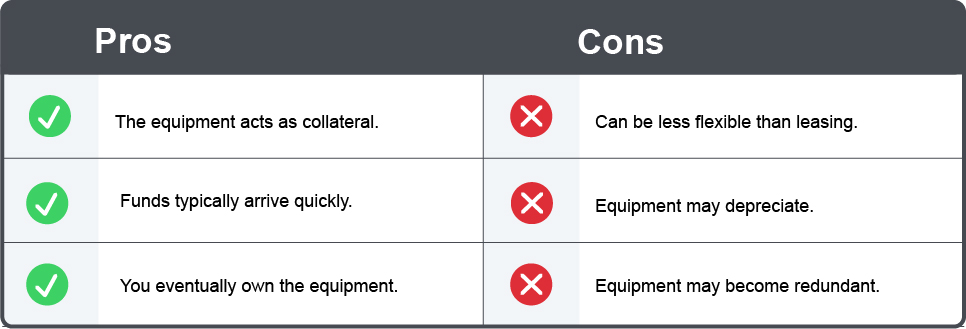

9. Equipment financing

Restaurants often need to fund things like coffee-makers, POS technology, premium ovens, grills and stoves. This is where equipment financing can help. Here are its pros and cons.

Is equipment financing right for your restaurant?

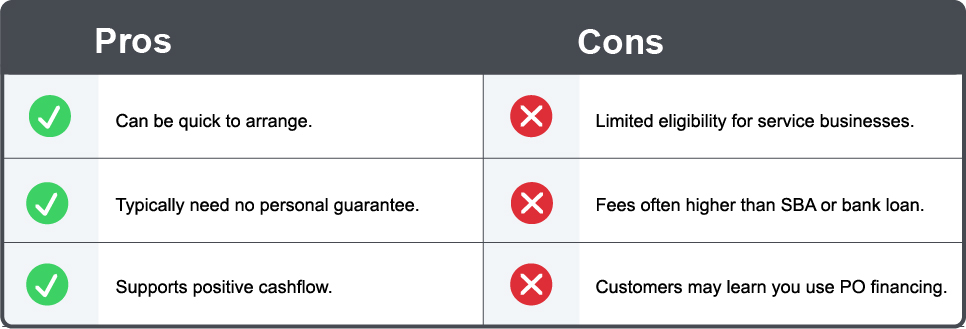

10. Purchase order (PO) financing

As every business owner knows, orders are often received and completed long before they are paid for. You probably know this only too well, if your restaurant offers a catering service, for example. Purchase order (PO) financing can be a useful option for restaurants that don’t have enough cash flow to complete outstanding orders.

Is PO financing right for your restaurant?

6 ways to evaluate restaurant financing and loans

As you can see, the funding options we’ve looked at vary widely. Here’s what to do next, if you’ve started to hone in on some possible options from the list above. Take the following steps when assessing each option:

1. Check how quickly you get your capital

When choosing a financing option, an important point to consider is the time before you can actually use the capital. Do you need the money in a few months for an expansion? Or did your fridge break and you need to buy new equipment today? These factors will determine which option works best for your business.

2. Evaluate total repayments

Restaurants can calculate the total repayments of their financing by considering several key factors. First, they need to determine the loan amount, which is the principal borrowed from the lender. Next, they should identify the interest rate applied to the loan, whether it is fixed or variable. With these two pieces of information, they can calculate the interest expense by multiplying the loan amount by the interest rate. Additionally, they should consider any fees associated with the loan, such as origination fees or prepayment penalties and factor those into the total repayment amount.

Once the interest expense and fees are determined, restaurants can add them to the loan amount to obtain the total repayment amount. To understand the repayment structure, they should also determine the repayment term, the number of monthly or yearly payments required. By multiplying the monthly or annual payment amount by the total number of payments, restaurants can calculate the total repayments over the loan term. It is essential to consider these calculations carefully to assess the affordability of the financing and make informed decisions regarding their financial obligations.

3. Compare the term of the loan

In restaurant financing, the repayment term refers to the agreed-upon period over which the borrower must repay the borrowed funds, including any accrued interest and fees. It is the duration within which the loan must be fully repaid to the lender. The repayment term is typically specified in months or years and is a vital aspect of the loan agreement. The length of the repayment term can vary depending on the specific terms of the loan, the amount borrowed, the borrower’s financial profile and the lender’s requirements.

Shorter repayment terms usually mean higher monthly payments but result in faster loan payoff and potentially lower overall interest costs. On the other hand, longer repayment terms often result in lower monthly payments but may entail higher interest expenses over the life of the loan. It is important to carefully consider the repayment term and choose a duration that aligns with their financial capabilities and long-term business plans.

4. Compare the benefits of fixed vs. variable rates

When comparing the benefits of fixed versus variable rates when financing, restaurants should consider several factors. Fixed rates provide stability and predictability, as the interest rate remains constant throughout the loan term, allowing restaurants to budget and plan accordingly. This can be advantageous during periods of economic uncertainty or when interest rates are expected to rise. On the other hand, variable rates may offer lower initial interest rates, providing potential cost savings in the early stages of the loan.

However, they also introduce the risk of rate fluctuations, meaning that the interest rate can increase over time, potentially increasing the restaurant’s borrowing costs. Restaurants should carefully assess their financial situation, risk tolerance and market conditions to determine which option aligns best with their long-term financial goals and stability requirement.

5. Find out of collateral is needed

Finding out if collateral is needed is crucial when looking for restaurant financing due to its significant implications on the borrowing process and risk management. Collateral serves as security for the lender, reducing their risk by providing an asset that can be seized and sold in the event of loan default.

Understanding whether collateral is required helps restaurants assess their ability to meet the lender’s criteria and determine if they have sufficient assets to secure the loan. It also impacts the loan terms, interest rates and borrowing capacity. By clarifying collateral requirements early on, restaurants can make informed decisions, explore alternative financing options if necessary and ensure they are adequately prepared to meet the lender’s conditions and protect their business assets.

6. Review the lender’s reputation

When it comes to money and financing, Reviewing the lender’s reputation is a crucial step. A lender’s reputation reflects their track record, credibility and reliability in the industry. Restaurants should conduct thorough research, seek feedback from other borrowers and review online resources to assess the lender’s reputation. This includes evaluating their customer service, responsiveness and transparency in their lending practices. Have you worked with this lender before? Do you know of other restaurants or businesses that have worked with them before?

A reputable lender will have a positive reputation, demonstrating a history of fair and ethical dealings, competitive interest rates and clear loan terms. They should have a solid financial standing, ensuring they can provide the necessary funds and support throughout the loan term. By reviewing the lender’s reputation, restaurants can mitigate the risk of potential issues or unfavorable experiences, ensuring a positive and beneficial financing partnership.

You might not even need to look far for lending options. Some of your existing providers might already offer funding options. Partnering with a POS provider that provides secure access to funding is a great way to remove some of the risk from financing.

Your financing and loans fit

Taking a step to expand or support your restaurant business can be equal parts exciting and nerve-wracking. Ultimately, you’ll know best which is the right option for your business as you continue to look into funding sources.

If you’re currently a Lightspeed customer, reach out to your Account Manager to find out if you’re eligible for Lightspeed Capital.

Lightspeed business Wander the Resort chose Lightspeed Restaurant to integrate with its hotel management system Cloudbeds. They’ve saved hundreds a month on fees and have increased their offerings and revenue streams as a result.

Ready to take the next step for your restaurant? Talk to one of our experts to find out how Lightspeed can help.

FAQ

How do you get financing for a restaurant?

There are many ways you can get financing for your restaurant, including: merchant cash advances, bank loans, small business loans and a business line of credit. Talk to a financial advisor to see what the best option is for you.

How much do you budget to pay back restaurant financing?

Depending on the financing you use, your bank, credit union or accountant will provide you with an amortization schedule.

How hard is it for a restaurant to get financing after declaring bankruptcy?

It depends. In general, it’s important to take the time to build your credit, build steady income, pay existing debts and flesh out a long-term business plan.

How hard is it to finance a restaurant?

There are plenty of funding options out there to get the financing you need for your restaurant. Whether you’re opening new locations, buying new equipment or paying for operating expenses, there’s a plan out there for you.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.