As a retailer, you likely take a number of credit and debit card payments every day—but have you ever wondered how long it takes to process a transaction from the time you take the payment until the funds are deposited in your business bank account? And why?

In this blog, we’ll answer:

- How long it takes to process credit card transactions

- How long other payment types take to process

- When the transaction fees are deducted

- Why it can take so long for credit card transactions to process

- How payment processing works

- How merchants can track their transaction processing status

Let’s dive in!

Choosing the right credit card processor

9 things to consider before signing on the dotted line.

How long does a credit card payment take to process?

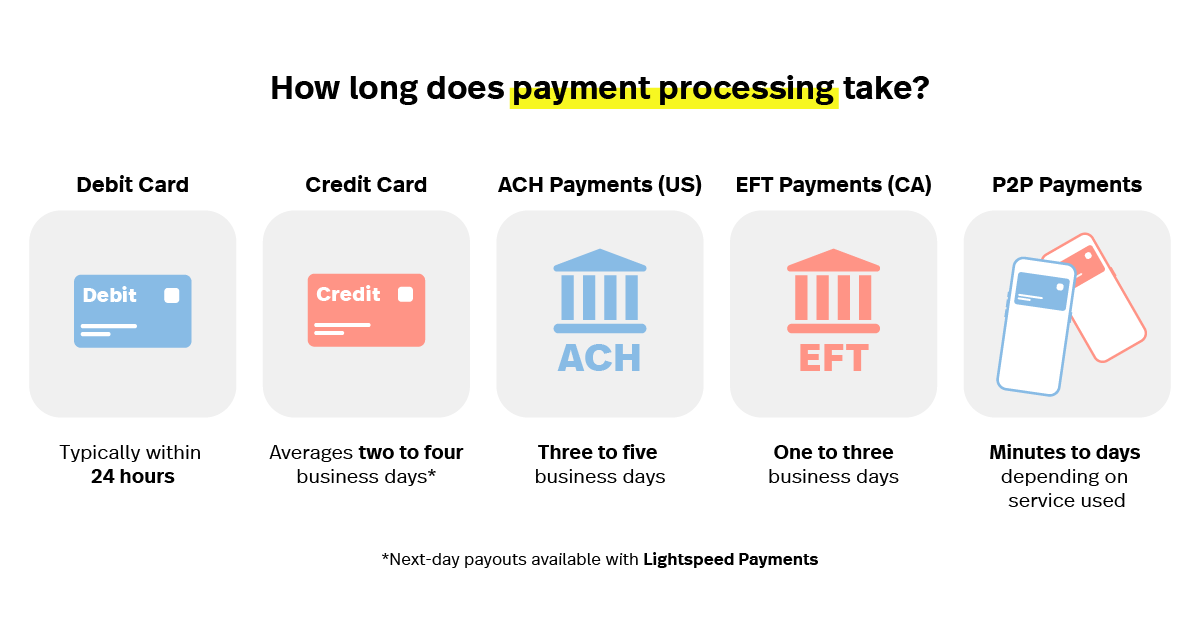

Generally, it takes two to four business days for payments to be processed from the customer’s card, through the bank and to your account.

This means if you process a payment on Friday, you’ll receive the funds on Tuesday. Payments taken on weekends and bank holidays are sent along with the batch of payments collected on the next weekday—you’ll receive funds from Saturday, Sunday and Monday at the same time.

Some payment processors, like Lightspeed Payments, take less time on average, allowing for next-day payouts.

With both Lightspeed Payments and other third-party payment processors, these times are not set in stone—unusually large settlements may take longer to process, for example.

Other types of payments and how long they take to process

Not all payments are processed the same way, and as such, not all types settle at the same rate.

Debit card payments

Debit card payments generally settle within 24 hours.

ACH payments

Automatic Clearing House (ACH) payments are direct payments transferred electronically in the United States. They do not involve credit cards, cheques or cash. Businesses taking subscription payments may do so through ACH.

Right now, ACH payments take three to five business days to clear. Nacha, the organization that governs the ACH network, has voted to build infrastructure for same-day ACH payments, but that will take time to get up and running.

What about EFT payments?

In Canada, Electronic Fund Transfer (EFT) payments take the place of ACH. EFT payments clear faster than ACH payments, typically within one to three days.

Peer2peer

Peer2peer (P2P) payments connect to a bank account or credit card and allow for fund transfers between customers of a P2P network.

Generally, P2P payments can be used immediately if used within the P2P network; transferring those funds out of the network and into a bank account can take a few days. Services like Zelle (in the US) and Interac e-transfer (in Canada) are the exception, as they deposit immediately.

Contactless

Contactless payments, where customers tap an EMV-enabled chip card or a capable mobile phone to a card reader, are on the rise. More than half of Americans use them to pay.

Like inserted or swiped cards, contactless payments generally take two to four days to settle.

When are the transaction fees taken out of a payment?

Fees are automatically deducted from payments before they’re deposited into your account, so you don’t have to worry about paying them yourself every single time you process a transaction.

The exact amount deducted from your funds will depend on the fee structure you have with your payment processor. When you’re in the process of finding a payment processing provider, look out for hidden transaction fees.

If you’re working with an interchange plus fee structure, each transaction will have a different fee applied to it thanks to variables in card type, issuing bank, entry type and more—you have no way of knowing the final amount that will be deposited into your account.

If you’re working with a tiered fee structure, you’ll have a set percentage and transaction fee for each transaction tier. Typically, qualified transactions will have a favorable rate, while mid-qualified and non-qualified transactions will cost you a lot more. Unfortunately, you get no say over how your transactions are classified, and the majority of your transactions are likely to be processed with the less favorable rates.

If you’re working with a flat fee structure, you’ll have one fee for card-present (CP) transactions and one fee for card-not-present (CNP) transactions, no matter the card type. You can calculate the expected amount you’ll be paying on each transaction by applying the flat rate for that transaction type.

Flat fee structures can help you avoid unexpected hits to your revenue. Jewelry retailer Melissa Joy Manning ditched unpredictable fees with a flat percentage fee from Lightspeed Payments. “With credit card processing fees and bank fees, we’re always trying to lower them because that’s just money out the door.”

Why does it take so long for credit card payments to post?

Payment processors generally don’t process every single payment at once. They batch payments together and send them for processing all at the same time. This can happen as quickly as twice a day, or as rarely as twice a week.

There’s another reason for the delay: fraud detection. After the initial verification at checkout, the card issuers can take a day or two to investigate purchases. This is why bigger transactions take longer to clear—they have a bigger impact if they’re fraudulent, so the card issuer is incentivized to take their time.

Do credit card payments process on weekends?

No, credit card payments are not processed by banks on the weekends.

Once the payments have been batched and sent to process, they’re at the mercy of the card network and the bank. Banks don’t operate on 24/7 schedules, and instead only process payments during work hours.

How does payment processing work?

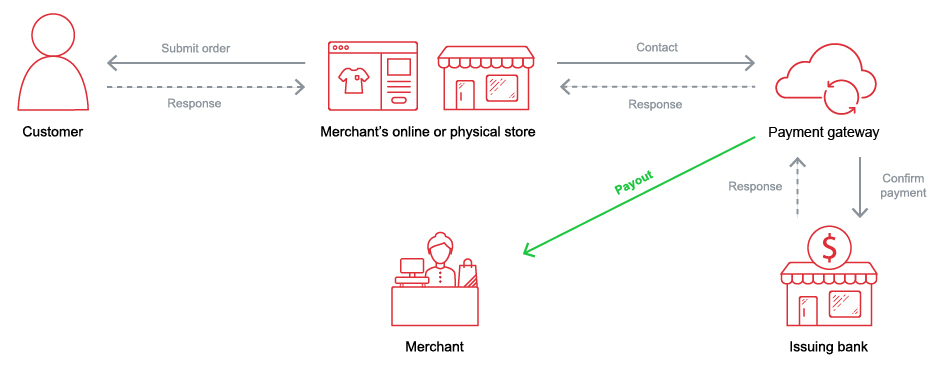

Payment processing happens in stages. The first stages, authorization and authentication, happen in-store when a customer buys something from you—these stages verify the payment. The steps involved in verification usually only take a few seconds in total.

- A customer taps, inserts or swipes their debit or credit card at your point of sale. The information needed to verify the transaction is sent to your processor.

- Your processor authorizes the payment with the card’s network, such as Visa or Interac.

- After the payment has been authorized, it needs to be authenticated. The card’s network sends the information needed to confirm the card’s validity to the customer’s issuing bank.

- The bank verifies that the card is being used legitimately and has access to the funds or credit card limit required to complete the sale, then either approves or declines the transaction. This is the end of the sale in your store.

Every transaction you make at your payment terminals is gathered together into a batch to be sent for processing. That batch is sent off to be processed in the third stage, settlement—this is the part that typically takes two days.

- At a set time every weekday, your daily batch of authorized and authenticated payments are sent to your payment processor for settlement.

- Your payment processor takes care of forwarding transactions in the batches to the appropriate card networks, who then request the funds from the issuing banks.

- The funds are sent to you and your customers have the transaction added to their credit card bill or automatically debited from their account.

What’s the difference between payment verification and payment processing?

Payment verification involves the authentication and authorization stages and happens immediately. Authorization and authentication ensure the funds are available to be deposited in your account by placing a hold on them. Until the funds have been transferred to you through the settlement process, the money is effectively in limbo between you and the customer.

Payment processing involves the settlement stage and takes time to process. This moves the funds owed to you into your account as the payments are cleared. The money has been taken out of limbo and paid to you.

How do you track a transaction’s processing status?

If a payment is taking longer than two days to process, you may want to check in on its status.

You also want to track the breakdown of card types in your batches, particularly if you find you’re paying for expensive interchange plus fees.

How can a business get visibility on transaction processing status?

Unfortunately, there is no way to easily track the status or breakdown of a batch of payments through your acquiring bank or your customer’s issuing bank.

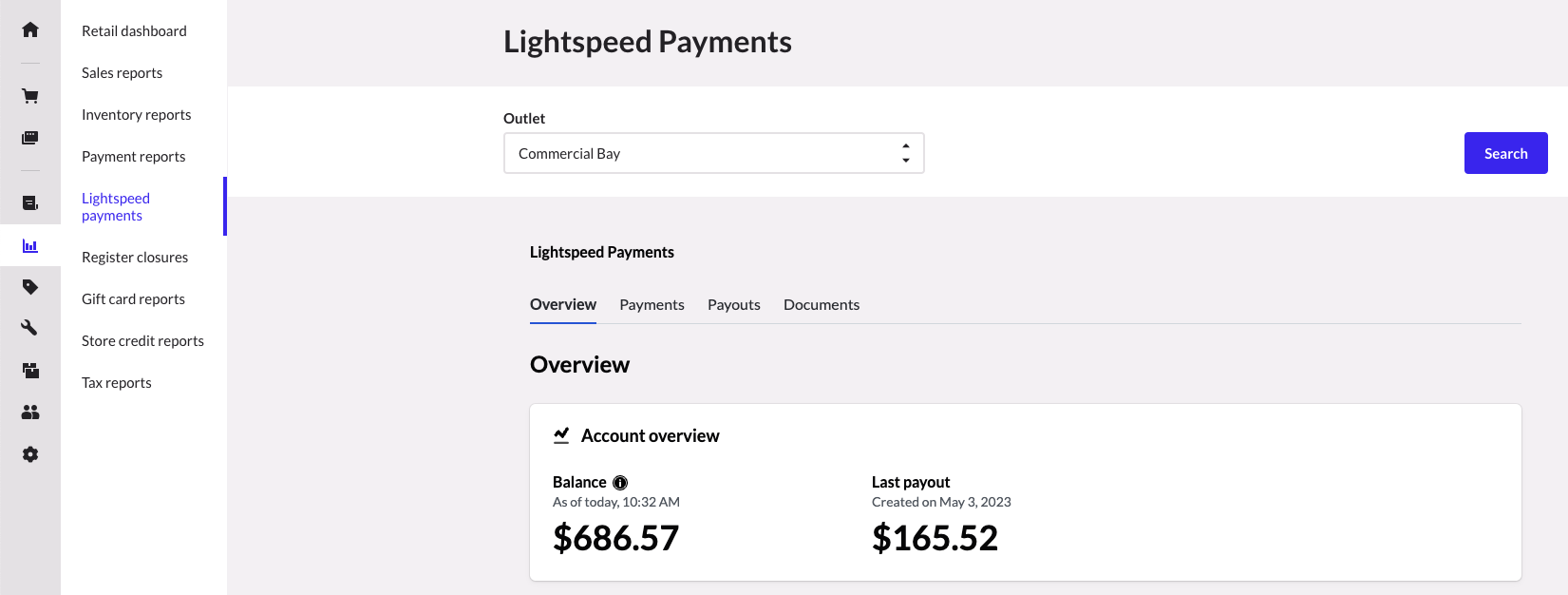

However, your payment processor may provide you with reports to check this data. While not all of the reports from all processors are easy to read, some–such as Lightspeed–have developed clear tools for Lightspeed Payments users to access with the click of a button.

If you’re using Lightspeed Payments, you can easily track the status of your settlements with the merchant portal. Let’s take a look at what information you could find.

Whenever you make a sale through your payment terminal, that transaction will be added to the merchant portal for easy reference. These transactions are batched together into settlements. Settlements marked as paid have been processed and had their funds forwarded to your bank from Lightspeed Payments.

The payments summary will show you transactions and their card types, such as American Express or Visa. You can also clearly see the fees you’re paying on the summary.

You can also check the details of a payment, including:

- Transaction date and time

- Payment Method

- Processor ID

- Timeline

- Authorized amount

- Captured amount

- Fee

- Device

- User

- Net amount

- Payment ID

- Order ID

Process transactions securely with Lightspeed Payments

Debit and credit cards, as well as mobile wallets and digital payments, are the overwhelming preferred payment method with customers, with cash consistently rated as the least preferred. By not opting to process debit and credit card transactions, retailers risk losing sales from cash-averse customers.

Rather than take that risk, merchants should start accepting card transactions to maximize their sales.

Rather than work with third-party payment processors and their notoriously complex contract agreements, consider using Lightspeed Payments, payment processing that’s embedded directly with your retail POS system.

We take the hassle out of taking payments, even when your customer wants to use their American Express card. Get built-in PCI compliance and stop worrying about third-party accounts—we’ll take care of that for you.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.

![11 Tips To Make Your Pop-Up Shop a Roaring Success [For Retail Store Beginners and Pros Alike]](https://blog-assets.lightspeedhq.com/img/2021/06/2da3ae10-blog-hero_pop-up-shop.jpg)