Small business accounting tips don’t have to send you running for the hills. Maybe the phrase small business accounting sends shivers down your spine. Or maybe it’s something that you know is important, but don’t particularly love spending time on.

One thing’s for sure. When you get a good grasp of basic accounting and bookkeeping, you get a better understanding of your small business’s strengths and weaknesses.

And when you get into sound accounting and bookkeeping habits, you can even start to use them as a springboard to grow your small business.

That’s what this article is all about, giving you a primer on accounting that will hopefully stand your small business in good stead for the years ahead.

We’ve asked accounting experts and small business owners just like you to explain:

- Why you should get a business account

- Why accountants and bookkeepers add value

- Two ways to report income and expenses

- Why you should pay yourself a salary

- How software can simplify accounting

- The importance of payroll laws

- Budgeting and forecasting

Let’s start by talking about that business bank account and why you should separate your personal and business income and expenses.

Make smarter decisions and run a more efficient business by leveraging your business data. This free guide will help you get started.Retail math made simple

Get a business bank account

As a small business owner, some of your business-related monies tend to get mixed in with your personal funds. The last thing you want to do is sit down and go through each and every shopping list or personal transaction to find specific business expenses.

This is why Barb Weidner, co-founder and CEO of online lending marketplace, Fast Capital 360, suggests you get a business bank account as soon as possible as one of her top small business accounting tips.

“Not establishing a business bank account can become an accounting nightmare when trying to separate business and personal expenses,” said Weidner. “Muddy waters in this area are never welcome when it comes time to file your taxes,” she said.

Tip: “Remember to check the banking fees first before diving into a well-marketed bank account. Some fees are very high, there may be flat fees or there may be a fee per transaction,” said Richard Ford, co-founder of Hart Accounting Services.

Hire an accountant and bookkeeper

Here’s another choice you should make as early as possible is whether to do your own ‘books’ and tax or get a professional to handle them for you.

Many small business owners try to wear the hats of both a bookkeeper and an accountant. But let’s be honest here, don’t you have enough to do already?

It really is better to have a professional accountant who can handle these duties and who will probably know more about lowering your tax burden than you would as a business owner.

Keep your accountant and bookkeeper in the loop

And your relationship with your accountant and bookkeeper doesn’t need to revolve around tax time either. “Even if you’re busy, stay in touch with your accounting team,” said Ethan Howell, co-owner of Florida Environmental. “Consider them as business advisors. Partners who can help you with taxes, financial flow, budgeting, etc. Never be afraid to ask them to define a phrase they use in an email or document,” he said.

Decide how to report income and expenses

You’ll also need to decide whether to use cash-based accounting or accrual accounting.

Definitely talk to your accountant about this, if you have one. But let’s break down this important choice, with a quick explanation of what each of these reporting methods are all about, plus some thoughts from various accounting experts.

What is accrual accounting?

Here’s how Tyler Davis, CPA, of Simplify LLC, explains it:

“Accrual accounting requires businesses to report income when the revenue is earned rather than when the cash is received. Additionally, under accrual account, expenses are recorded when incurred, not when paid. As you can see, the accrual basis of accounting limits flexibility for business owners on the period where income and expenses are reported.

When to use accrual accounting

Accrual may be suitable for businesses that:

- Are larger

- Have inventory

- Have shareholders and investors

- Have more complex structures.

However, small businesses can still use the accrual method for their own internal purposes, according to Tim Yoder, CPA, a Tax and Accounting Analyst. “This is helpful so they get a better measure of profitability by recognizing income and expenses as they are incurred versus paid. You can give your tax preparer accrual-basis financial statements and they can very easily convert them to the cash basis for your tax return,” he said.

What is cash accounting?

Again, here’s how Tyler Davis, CPA, of Simplify LLC, explains it:

“The cash method allows business owners to report revenue when cash is received and then report expenses when actually paid. Having control over the timing of revenue and expenses provides small businesses with tax planning opportunities at the end of the year.”

When to use cash accounting

Cash accounting may suitable for businesses that:

- Are smaller

- Do not have inventory

- Sell services, not products.

“Unless you benefit from accrual significantly, stay with cash or hybrid accounting in your early years,” suggests Crystal Stranger, an enrolled agent (EA), International Tax Director at Cleer Tax and the author of The Small Business Tax Guide.

“It is easy to switch from cash to accrual with the IRS, but nearly impossible to switch the other way around. Cash is simpler for most entrepreneurs to understand, and accrual too early can lead to some unpleasant surprises on the tax end if you don’t have an in-house CFO watching the balance sheet closely,” she added.

The hybrid method

In other words, you should probably rely on cash but keep an eye on accrual too. “Most accounting software allows you to switch between cash and accrual accounting,” said Mike Jesowshek, CPA, the Founder and Host of the Small Business Tax Savings Podcast. “So you have the ability to run on a cash basis but still track accounts receivable (AR) and accounts payable (AP) for internal purposes so you are keeping track of outstanding items.”

Pay yourself a salary

Here’s one of the often-overlocked small business accounting tips for the early days, pay yourself properly.

Paying yourself a regular, repeatable salary helps you keep the business on an even keel. Brett Larkin, the founder and CEO of Uplifted Yoga, believes this will make your life so much easier than constantly using your business account to pay personal expenses. “It makes it simpler to stay within budget, less stressful to track, and it reinforces the all-important idea that your business and personal accounts are entirely separate,” he said.

Get bookkeeping software

Whether you’re doing your own books and tax or getting professionals to handle them for you, you’re going to need reliable bookkeeping software too.

Cloud-based accounting and bookkeeping software marks a big departure from the old days, where people had to go through piles of paperwork, check spreadsheets and perform manual calculations.

“With cloud-based software, you can automate these processes and make your life much easier,” said Alex Williams, CFO of FindThisBest, a guide for shopping retail products. “Choose from any of the numerous software options out there and automatically send invoices, track expenses and generate reports.”

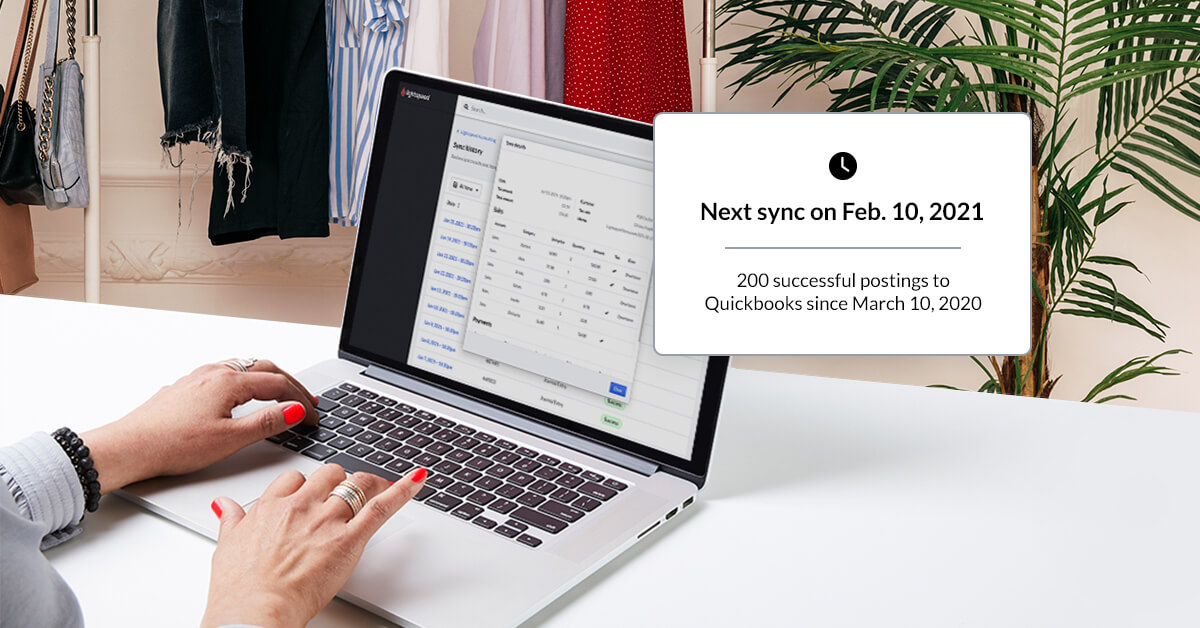

Consider using Lightspeed Accounting

Lightspeed accounting allows small businesses to automate sending all their sales data directly to a broad range of accounting software, such as Quickbooks, Xero, and Sage. we recently launched accounting integrations to help small businesses:

- Reduce human errors by automating manual processes

- Provide an automated daily summary of sales

- Tracks revenue streams across multiple locations.

Lightspeed Accounting users spend on average five minutes a day on bookkeeping tasks that would previously take hours to complete manually. Please note that you must be a Lightspeed customer to take advantage of Lightspeed Accounting integrations.

Comply with payroll laws

Be aware of state and nationwide labor and payroll laws too.

Implement a system to ensure you’re following these laws and staying up-to-date on the latest changes regarding payroll management, suggests Brad Tousenard, founder & CEO of SpinupWP, a software company offering a cloud-based server control panel for WordPress.

“Be aware that remote employees that live in a state with state income tax are required to have state income tax deducted from their wages and remitted to their home state. For states with income tax, it’s your responsibility as the employer to ensure the taxes are deducted correctly and paid on time to the relevant state agency,” he said.

Budget and forecast

Again, there are many apps and software that can help you do this. In truth, in the early days, the budgeting piece will probably be more important than the forecasting.

“As a small business owner, budgeting was never easy for me,” said Sara Cemin, founder and editor of Realiaproject.org, which creates templates and forms for businesses and academics.

“What I’ve learnt over the years is that you must check your historical performance. Use that as leverage to create your budget. Additonally, you should keep some extra cash handy for any bad days or bad months,” she said.

Staying across your small business accounts

In a nutshell, accounting is about much more than reporting your income and expenses. It’s a discipline that can become a central driver of your small business’s performance.

Discover how Lightspeed can help your small business maintain accurate revenue and expenses data and simplify your accounting with our integrations. Get in touch with our experts to see how Lightspeed can help you simplify your accounting, along with many other tasks, today.

Editor’s note: Nothing in this blog post should be construed as advice of any kind. Any legal, financial or tax-related content is provided for informational purposes only and is not a substitute for obtaining advice from a qualified legal or accounting professional. Where available, we’ve included primary sources. While we work hard to publish accurate content, we cannot be held responsible for any actions or omissions based on that content. Lightspeed does not undertake to complete further verifications or keep this blog post updated over time.

News you care about. Tips you can use.

Everything your business needs to grow, delivered straight to your inbox.

![11 Tips To Make Your Pop-Up Shop a Roaring Success [For Retail Store Beginners and Pros Alike]](https://blog-assets.lightspeedhq.com/img/2021/06/2da3ae10-blog-hero_pop-up-shop.jpg)