Here we are at the beginning of a new year and the end of our third quarter. We’re entering the final phase of our Year of Execution, pushing forward on multiple fronts to deliver on our objectives.

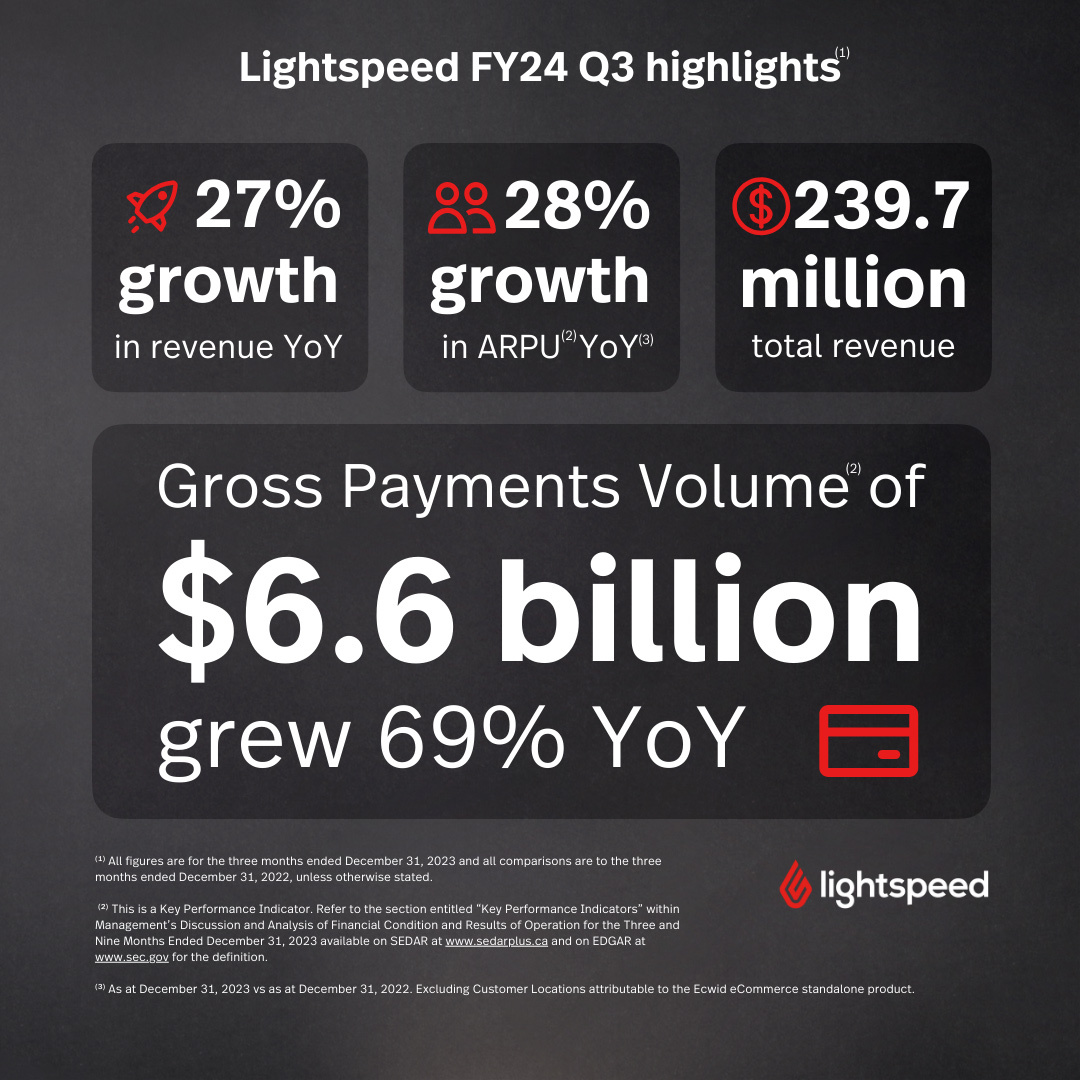

And deliver we have – in huge strides. In short, we beat our own expectations, surpassing our previously established revenue outlook of $232 to $237 million. Our move towards Unified Payments helped drive our revenue to reach $239.7 million – a 27% increase in revenue year-over-year. Net loss and Adjusted EBITDA improved to ($40.2) million and $3.6 million, respectively.

In more good news, GPV2 as a percentage of GTV2 was 29% this quarter. We’ve reached other important benchmarks, as well. Transaction-based revenue grew 38% to $147.8 million. ARPU, is up to approximately $447, an increase of 28% year-over-year. We also saw a 69% increase in GPV year-over-year to $6.6 billion.

Our sophisticated, high GTV customer base keeps growing. Customer Locations with GTV exceeding $500K/year increased 7% year-over-year, while those with GTV under $200K/year4 declined (as we had planned for). And Customer Locations with GTV exceeding $1M/year4 increased 7% year-over-year.

This tells me that our customers see how our unified software and payments solution not only allows them to scale and innovate, it brings them value. They see that Lightspeed’s technology and insights equip them to take their business to the next level.

You can find even more about these numbers in the press release.

Now, let me tell you about what we accomplished in the last quarter.

Market leadership through relentless innovation

Our two flagship products are now available in almost all of our target markets around the world. These are best-in-class products, and ones that we believe are helping grow the competitive gap between us and our competitors.

To do that, we have to keep expanding and innovating our product offering. Our laser-focused innovation efforts have yielded a roster of new features. Let me highlight a few:

- In the US, we launched Lightspeed Tableside, our compact POS and payment processing device for restaurants. It allows servers to process orders instantaneously, right at the customer’s side. This improves speed and efficiency in the front of the house. This seamless process reduces wait times, increases table turnover, and improves customer satisfaction.

- Over in retail, we introduced the Lightspeed Retail and NuORDER Integration. This advanced technology was, until recently, only available to enterprise customers. Now, SMB retailers can order directly from thousands of brands through the NuORDER by Lightspeed platform, saving them hours per week.

- We also launched enhancements to Advanced Insights in Lightspeed Retail. Now, Dusty Inventory and Sell Through reports give a clear view of what needs stocking or what should be discounted, while Individual Performance and Sales by Hour reports help identify team members who are performing well.

- There were also significant advancements in EMEA. We launched Lightspeed Capital in France, the Netherlands and Belgium this quarter—and Germany shortly after the quarter—expanding our global footprint. And we launched Tap to Pay on iPhone in the UK and the Netherlands, allowing customers in those regions to accept payments right on their iPhone.

Sophisticated entrepreneurs choose Lightspeed

All around the world, the strength of our offering attracts established, savvy businesses with complex needs. Here are a few of the customers who chose Lightspeed last quarter, beginning with three new Michelin star restaurants:

Restaurant

- The River Café, an iconic UK restaurant overlooking the River Thames has selected Lightspeed to power their restaurant. Featuring Italian cuisine with one Michelin star, The River Café is known to have trained some of the greatest chefs, such as Jamie Oliver.

- In Germany, we signed the iconic Hæbel in downtown Hamburg—it has one Michelin star and a Michelin Green star for gastronomy and sustainability. In Berlin, we welcomed prism, a one Michelin star restaurant with elevated cuisine and an award-winning wine list. Hæbel and Prism have both selected Lightspeed Restaurant to power their restaurants.

- We are also pleased to say that Attica, a regular on the World’s 50 Best Restaurants list, has selected Lightspeed to operate their fine dining restaurant in Melbourne.

Retail

- Lolë Clothing, the Canadian athletic apparel designer, switched to Lightspeed from one of our cloud-based competitors to run a number of their locations across North America.

- In the UK, the high-end bicycle brand Pinarello signed up two of its locations with Lightspeed. This is a family owned and operated company. It has a single goal: to make the world’s best bikes.

- And in the US, we signed with Fit My Feet, a footwear retailer with six locations that moved from their on-premise legacy POS system to Lightspeed.

Supplier Network

- We welcomed several new brands to our Supplier Network. Some highlights include casual men’s companies Tommy Bahama, Baffin and UNTUCKit.

Five years ago, we began this journey

Five years ago, we went public. We’ve done incredible things together since then. We started with bold moves—we acquired and integrated nine companies, transforming them into two industry leading platforms. We rolled out Lightspeed Payments to our global customer base. We’ve made strategic moves to put us on the path to Adjusted EBITDA profitability. All the while, revenue grew over tenfold and GTV grew over fivefold. We maintained strong organic revenue growth and achieved Adjusted EBITDA profitability.

I’m proud of our team and of the company. I am confident that we’re in a strong position and can continue to build on the momentum from this last quarter to keep delivering sophisticated products and powerful financial services that help the world’s best businesses thrive.

-

This is a Non-IFRS measure. Refer to the section entitled “Non-IFRS Measures and Ratios and Reconciliation of Non-IFRS Measures and Ratios” within Management’s Discussion and Analysis of Financial Condition and Results of Operation for the Three and Nine Months Ended December 31, 2023 available on SEDAR at www.sedarplus.ca and on EDGAR at www.sec.gov for the definition and reconciliation of the Non-IFRS measure to net loss, which is incorporated by reference herein.

-

This is a Key Performance Indicator. Refer to the section entitled “Key Performance Indicators” within Management’s Discussion and Analysis of Financial Condition and Results of Operation for the Three and Nine Months Ended December 31, 2023 available on SEDAR at www.sedarplus.ca and on EDGAR at www.sec.gov for the definition.

-

As at December 31, 2023 vs as at December 31, 2022. Excluding Customer Locations attributable to the Ecwid eCommerce standalone product.

-

Excluding Customer Locations and GTV attributable to the Ecwid eCommerce standalone product, Lightspeed Golf and NuORDER by Lightspeed product. A Customer Location’s GTV per year is calculated by annualizing the GTV for the months in which the Customer Location is actively processing in the last twelve months.